Market Overview:

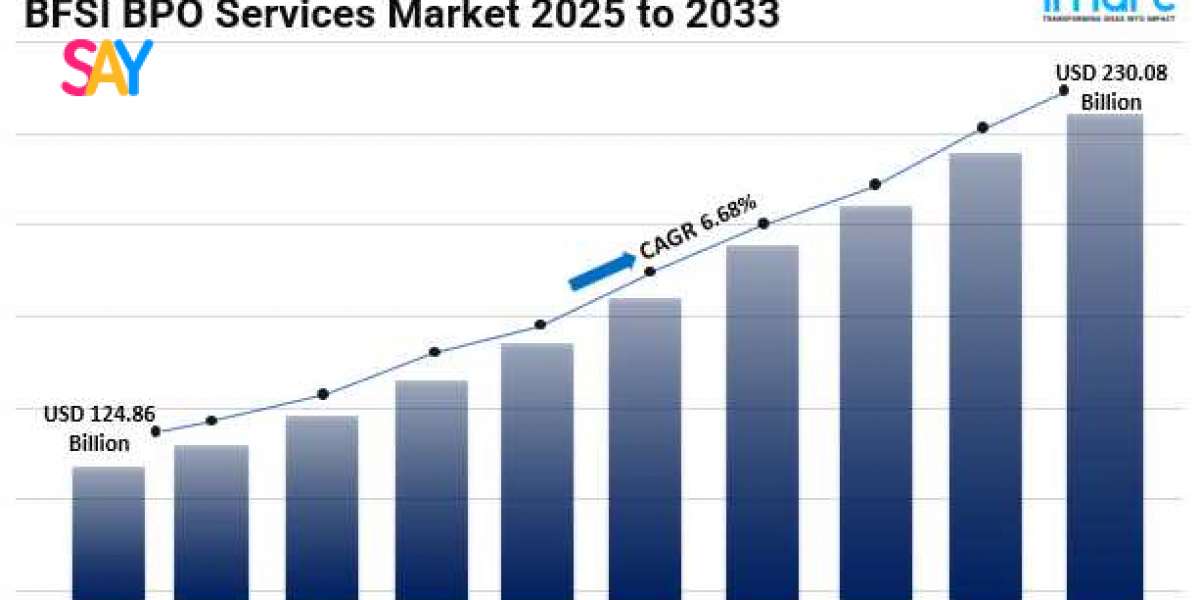

The global BFSI BPO services market is experiencing robust growth, projected to expand from USD 124.9 billion in 2024 to USD 230.1 billion by 2033, at a CAGR of 6.68% . This growth is driven by stringent regulatory requirements, rapid technological advancements, and an increasing demand for enhanced customer experiences. Financial institutions are increasingly outsourcing non-core functions to specialized BPO providers to optimize operations, reduce costs, and focus on core competencies.

Study Assumption Years:

- Base Year: 2024

- Historical Year: 2019–2024

- Forecast Year: 2025–2033

BFSI BPO Services Market Key Takeaways:

- Market size reached USD 124.9 billion in 2024 and is projected to reach USD 230.1 billion by 2033, growing at a CAGR of 6.68%.

- North America leads the market with a 36% share in 2024.

- Customer services hold the largest share among service types.

- Large enterprises dominate the enterprise size segment.

- Banks are the primary end users, encompassing commercial and retail banking, cards, and lending.

- The integration of AI, RPA, and blockchain is enhancing operational efficiency.

- Regulatory compliance and cybersecurity concerns are significant drivers.

Market Growth Factors:

Technological Advances: The rapidly developing technologies such as AI, robotic process automation, and blockchain, are currently leading BFSI BPO services into a whole new dimension. Application of AI and RPA to program repetitive mundane tasks replaces human tasks with the best possible efficiency, if not all human errors. Overall, blockchain builds secure data yet makes it very transparent over a financial transaction. These advancements allow financial institutions to offer faster, secure services, which would therefore attract more clients and growth for the sector.

Regulatory Compliance and Risk Management: The BFSI sector is one roof under which stringent laws and regulations reside that require the adoption of robust compliance measures. Such specialist BPO companies who focus on risk management provide services towards ensuring compliance with such rigorous requirements to financial institutions thereby reducing their data breach and operational fraud incidence. Financial institutions such as banks and insurance companies through outsourcing of such operations focus on the main tasks but are assured compliance, thus facilitating market growth.

Demand for Improved Customer Experience: The focus among financial institutions is now more towards enhancing the qualities of their customers. Customer support, claims processing, and loan origination, as aspects of BPO services, enhance service delivery across the board for financial institutions. The services provided through these digital channels and individual-based service provisions meet new demands by the customers who, thus, lead to higher customer retention and new client attraction. That is the trend that drives customer-centric service, which is driving market expansion further.

Request Sample For PDF Report: https://www.imarcgroup.com/bfsi-bpo-services-market/requestsample

Market Segmentation:

Analysis by Service Type:

- Customer Services

- Finance and Accounting

- Human Resource

- KPO

- Procurement and Supply Chain

- Others

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Analysis by End User:

- Banks

- Commercial Banking

- Retail Banking

- Cards

- Lending

- Capital Markets

- Investment Banking

- Brokerage

- Asset Management

- Others

- Insurance Companies

- Others

Market Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Key Players:

- Accenture PLC

- Cognizant

- Concentrix Corporation

- Genpact

- IBM Corporation

- Infosys Limited

- Mphasis Limited

- NTT Data Corporation

- Tata Consultancy Services Limited

- Wipro Limited

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.