The plasma protein therapeutics market has gained significant traction due to its potential in treating a variety of chronic and life-threatening diseases. Plasma-derived therapies are essential in treating conditions like hemophilia, primary immunodeficiencies, and other autoimmune and bleeding disorders. Plasma proteins such as immunoglobulin, albumin, and clotting factors have a critical role in medical treatments. The global demand for these therapies is on the rise, making this market one of the most dynamic segments in the pharmaceutical industry. The market was valued at USD 30.4 billion in 2024 and is expected to grow at a compound annual growth rate (CAGR) of 6.1% between 2025 and 2034, reaching an estimated value of USD 51.8 billion by 2034.

Market Overview

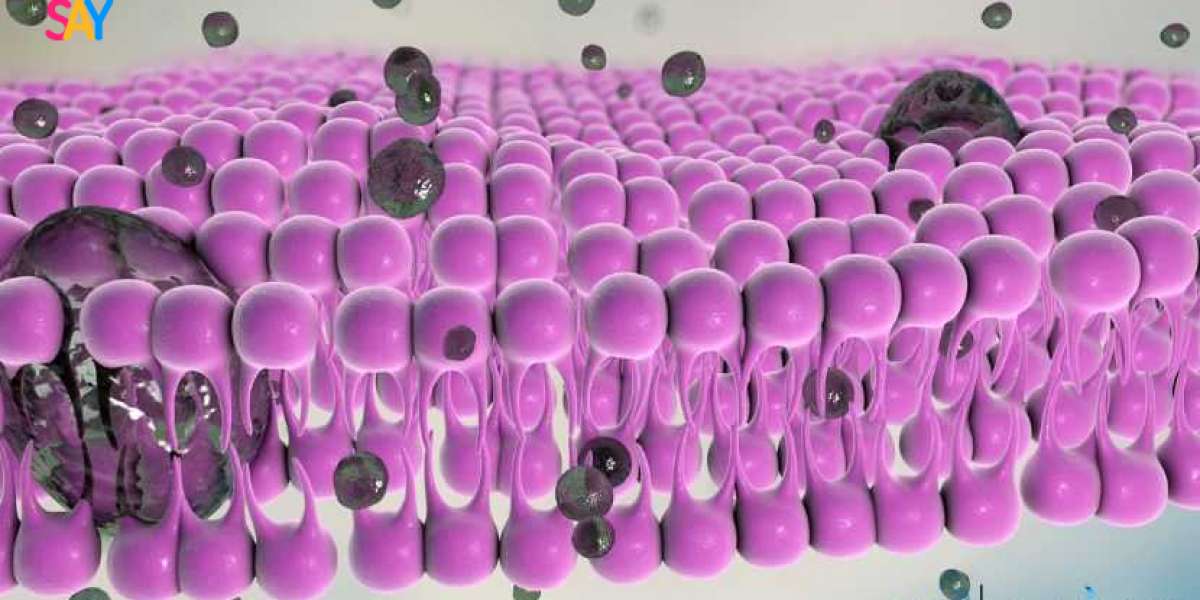

Plasma protein therapeutics refer to a range of products derived from human blood plasma, used to treat various medical conditions related to the immune system, blood clotting, and metabolic disorders. The primary plasma proteins used in therapies include immunoglobulins, albumin, and clotting factors. These therapies are used in a broad spectrum of medical applications, especially for conditions like hemophilia, immune deficiencies, and bleeding disorders. Plasma-derived therapies have shown promising results in improving the quality of life and survival rates for patients with these chronic conditions. As healthcare systems continue to develop, the demand for these life-saving therapies has surged, fueling the growth of the plasma protein therapeutics market.

Market Size and Share

The plasma protein therapeutics market size was valued at USD 30.4 billion in 2024 and is expected to grow at a CAGR of 6.1% from 2025 to 2034. As the market continues to expand, it is projected to reach USD 51.8 billion by 2034. This growth is primarily driven by an increasing prevalence of chronic conditions such as hemophilia, primary immunodeficiencies, and autoimmune diseases. Additionally, advancements in medical research, along with increasing healthcare infrastructure and rising awareness of plasma-derived therapies, are contributing factors to this expansion. Geographically, North America and Europe are expected to remain the largest markets, while Asia-Pacific is anticipated to grow at the fastest rate due to improved access to healthcare and rising disease incidence.

Market Trends

- Increasing Demand for Immunoglobulin (IgG) Therapies

The rising prevalence of autoimmune diseases and immunodeficiencies is driving the demand for immunoglobulin (IgG) therapies. Immunoglobulins are used to treat primary and secondary immunodeficiencies and other conditions like chronic inflammatory demyelinating polyneuropathy (CIDP). The increasing use of immunoglobulin in both hospital and homecare settings is fueling market growth. As the incidence of immunodeficiencies rises globally, the demand for IgG therapies is expected to maintain a steady upward trajectory throughout the forecast period. - Growth in Hemophilia Treatments

Hemophilia remains one of the largest applications of plasma protein therapeutics. Clotting factor products derived from human plasma, such as factor VIII and factor IX, are critical in treating hemophilia A and B. With an increasing number of hemophilia patients worldwide and the development of more effective and safer plasma-derived therapies, the market for these treatments is set to expand significantly. Moreover, rising awareness about hemophilia treatments and the improvement in diagnostic capabilities will continue to drive demand in the coming years. - Expansion of Home Care Solutions

The shift towards home care in plasma protein therapy is becoming a major trend, especially for chronic conditions such as primary immunodeficiencies and hemophilia. Home-based therapies for immunoglobulin and other plasma proteins are becoming increasingly popular due to their convenience and cost-effectiveness for both patients and healthcare systems. This growing trend is expected to significantly contribute to market growth by making plasma protein therapies more accessible to patients who prefer home-based treatments rather than frequent hospital visits. - RD in Plasma-Derived Therapies

There is a rising focus on research and development in the plasma protein therapeutics market to improve the efficacy, safety, and accessibility of these therapies. The development of next-generation plasma-derived therapies, such as extended half-life factor VIII for hemophilia patients, is expected to further propel the market. Ongoing clinical trials and technological advancements are anticipated to lead to the introduction of new and enhanced therapies, thus boosting the market for plasma protein products.

Market Analysis

- Product Type Breakdown

The market for plasma protein therapeutics can be segmented by product type, with key products including immunoglobulin, albumin, plasma-derived factors, and others. Immunoglobulin holds the largest share of the market due to its widespread use in treating a variety of immunodeficiencies and autoimmune conditions. Albumin is used in critical care for burn victims and patients with liver disease, while plasma-derived clotting factors are indispensable for treating hemophilia. The increasing demand for immunoglobulin therapies is expected to drive the market’s growth significantly. - Applications in Hemophilia and Immunodeficiencies

Hemophilia and primary immunodeficiencies represent the largest therapeutic applications for plasma protein therapies. Hemophilia treatment, through clotting factors like factor VIII and IX, is essential for managing bleeding episodes in hemophilia A and B patients. On the other hand, immunoglobulin therapies are widely used in patients with primary immunodeficiencies, autoimmune diseases, and other immune-related disorders. The ongoing growth in the incidence of these conditions, coupled with advancements in treatment protocols, will sustain the market’s expansion in these key applications. - End-User Breakdown

The plasma protein therapeutics market serves various end users, including hospitals, home care settings, and ambulatory surgical centers (ASCs). Hospitals are the primary consumers of plasma protein therapies, especially for critical care patients. However, the trend toward home care is growing rapidly, with more patients opting for home-based treatments. ASCs are also increasingly adopting plasma protein therapeutics, as they provide an efficient solution for outpatient care, especially for chronic conditions requiring long-term management. - Regional Insights

The plasma protein therapeutics market is growing at different rates across various regions. North America, particularly the United States, holds a dominant share of the market due to its advanced healthcare infrastructure, high demand for plasma-derived products, and strong reimbursement policies. Europe is another key market, with significant demand for immunoglobulin therapies. The Asia Pacific region is expected to grow at the fastest rate due to an increase in healthcare access, a rising prevalence of plasma protein therapy-related diseases, and increasing investment in biotechnology and healthcare services.

Regional Insights

- North America

North America remains the largest market for plasma protein therapeutics, with the U.S. being the dominant player. The demand for plasma-derived therapies, especially immunoglobulins, is high due to the increasing incidence of chronic conditions like hemophilia and primary immunodeficiencies. Additionally, the robust healthcare infrastructure, combined with favorable reimbursement policies, ensures a steady supply of these critical therapies. The region also benefits from the presence of several key market players and advanced research initiatives. - Asia Pacific

Asia Pacific is emerging as a rapidly growing market for plasma protein therapeutics. With the rise in healthcare access and the increasing prevalence of diseases that require plasma protein therapies, such as hemophilia and autoimmune disorders, the demand for these treatments is expanding. Additionally, countries like China and India are witnessing a surge in biotechnology innovations and investments in healthcare infrastructure, creating significant opportunities for growth in the plasma protein therapeutics sector.

Market Growth

The growth of the plasma protein therapeutics market is largely driven by an increasing prevalence of chronic and life-threatening conditions such as hemophilia, immune deficiencies, and other blood disorders. With improvements in healthcare infrastructure globally, particularly in emerging markets, the accessibility of plasma protein therapies is improving, contributing to the market's growth. Additionally, research and development efforts focused on enhancing the effectiveness, safety, and delivery methods of these therapies will continue to drive market demand. The increasing trend towards home care and personalized treatment plans will also fuel market growth in the coming years.

Get a Free Sample Report with a Table of Contents

Recent Developments Challenges

- Regulatory Approvals

Recent regulatory approvals for new plasma-derived therapies are expected to drive the market forward. For instance, the FDA’s approval of extended half-life factor VIII products for hemophilia patients has created new opportunities in the market. These innovations help address unmet needs in disease management, providing better outcomes for patients. - Home-Based Treatment Solutions

Home-based treatment options for plasma protein therapies are gaining traction. The growing acceptance of home care therapies, particularly immunoglobulin therapies, offers patients greater convenience and flexibility while reducing the burden on healthcare facilities. - Plasma Donation and Supply Chain Challenges

The supply of human plasma is a significant challenge for manufacturers of plasma protein therapies. The increasing demand for plasma-derived products has put pressure on the supply chain, leading to challenges in ensuring a steady plasma supply. Regulatory challenges regarding plasma collection and safety also contribute to the market’s constraints. - Market Competition and Pricing Pressures

The plasma protein therapeutics market is highly competitive, with numerous companies vying for market share. Pricing pressures due to competitive pricing, especially in regions with lower reimbursement rates, pose challenges for companies seeking to maintain profitability while providing affordable therapies.

Key Players

CSL Limited

CSL Limited is one of the largest players in the plasma protein therapeutics market, with a broad portfolio of immunoglobulin and albumin products. The company is known for its strong global presence and ongoing investment in research and development. CSL Behring, a subsidiary of CSL, focuses on providing treatments for bleeding disorders, primary immunodeficiencies, and other chronic conditions.

Baxter International

Baxter International is a leading player in the plasma protein therapeutics market, offering a range of products, including immunoglobulins and clotting factor therapies. The company has a robust presence in both developed and emerging markets, with a focus on expanding access to plasma protein therapies in underserved regions. Baxter’s commitment to innovation and patient care continues to position it as a market leader.

Grifols, S.A.

Grifols is a global leader in the plasma protein therapeutics market, specializing in immunoglobulins, albumin, and clotting factor therapies. The company’s strong RD capabilities and extensive global distribution network make it a prominent player in the industry. Grifols is also involved in various initiatives aimed at increasing the efficiency of plasma collection and improving the accessibility of plasma-derived therapies worldwide.

Takeda Pharmaceutical

Takeda Pharmaceutical is a key player in the plasma protein therapeutics market, with a focus on immunoglobulin therapies and other plasma-derived products. Takeda’s acquisition of Shire Pharmaceuticals has strengthened its position in the rare disease market. The company is actively involved in enhancing the safety and efficacy of plasma protein therapies through innovative research and partnerships.

Other notable players in the plasma protein therapeutics market include Octapharma AG, Bio Products Laboratory Ltd., and ADMA Biologics Inc.

FAQs

What is the plasma protein therapeutics market size in 2024?

The plasma protein therapeutics market was valued at USD 30.4 billion in 2024.

What are the major drivers of the plasma protein therapeutics market?

Increasing prevalence of chronic diseases, advancements in plasma-derived therapies, and growing demand for home care treatment options are key drivers.

Which region is expected to see the highest growth in the plasma protein therapeutics market?

The Asia Pacific region is expected to grow at the fastest rate due to improved healthcare access and rising disease prevalence.

What are the main applications of plasma protein therapeutics?

The main applications include hemophilia treatment, primary immunodeficiencies, and autoimmune diseases.

Read Our Blogs