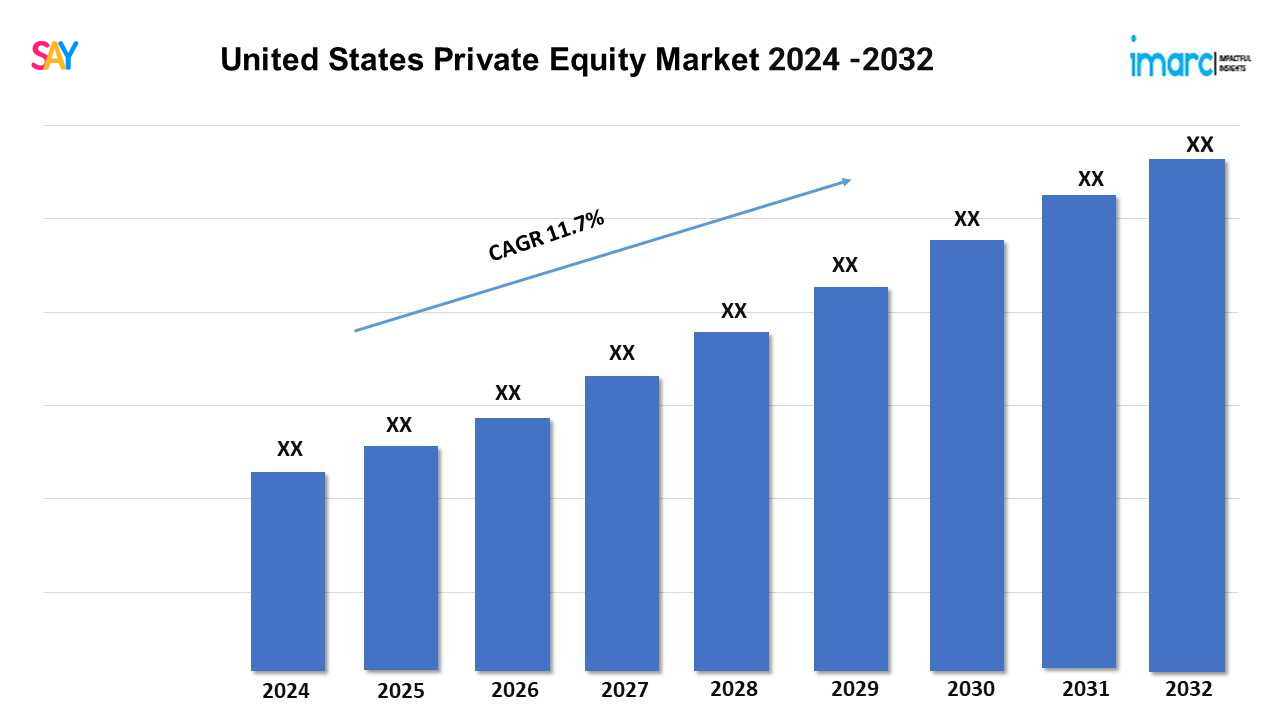

United States Private Equity Market Overview

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 11.7% (2024-2032)

According to the latest report by IMARC Group, the United States private equity market size is projected to exhibit a growth rate (CAGR) of 11.7% during 2024-2032. The market is witnessing steady growth, driven by the robust expansion of diverse industries and the increasing availability of capital.

The rising number of high-growth companies across sectors such as technology, healthcare, and renewable energy is creating substantial investment opportunities for private equity firms. Urbanization and innovation hubs in cities such as New York, San Francisco, and Chicago are also fueling activity as these regions foster startups and established enterprises seeking capital for growth and restructuring. Moreover, low interest rates and favorable regulatory frameworks are encouraging both domestic and international investors to allocate funds toward private equity ventures. Additionally, the adoption of innovative financial instruments, such as structured equity and growth capital, is expanding the scope of private equity investments. These tools provide flexibility to tailor investment structures to the unique needs of portfolio companies, facilitating growth and scalability.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/united-states-private-equity-market/requestsample

United States Private Equity Industry Trends and Drivers:

Key trends in the United States private equity market include the growing emphasis on sustainable and impact investing. Private equity firms are increasingly prioritizing environmental, social, and governance (ESG) factors in their investment strategies, responding to investor demand for responsible and purpose-driven investments. This shift is fostering growth in sectors such as clean energy, sustainable agriculture, and healthcare innovation. Additionally, the rising popularity of technology-focused investments is a notable growth-inducing trend. With digital transformation reshaping industries, private equity firms are actively pursuing opportunities in cloud computing, artificial intelligence (AI), fintech, and e-commerce. These investments are driving returns and also supporting innovation and competitiveness across the economy. Furthermore, the focus on middle-market and small-cap companies, which often present untapped growth potential, is diversifying the range of opportunities available to private equity firms. Moreover, the integration of advanced analytics and artificial intelligence into investment decision-making is improving the ability of firms to identify high-potential opportunities and optimize portfolio performance. Other than this, government initiatives to stimulate innovation and economic growth, including tax incentives and funding programs for emerging industries, are contributing substantially to industry expansion. The increasing trend of institutional investors such as pension funds, endowments, and sovereign wealth funds allocating larger portions of their portfolios to private equity is further strengthening the sector.

United States Private Equity Industry Segmentation:

The report has segmented the market into the following categories:

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Regional Insights:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert Browse Full Report with TOC List of Figure: https://www.imarcgroup.com/request?type=reportid=11395flag=C

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145