South Korea Trade Finance Market Overview

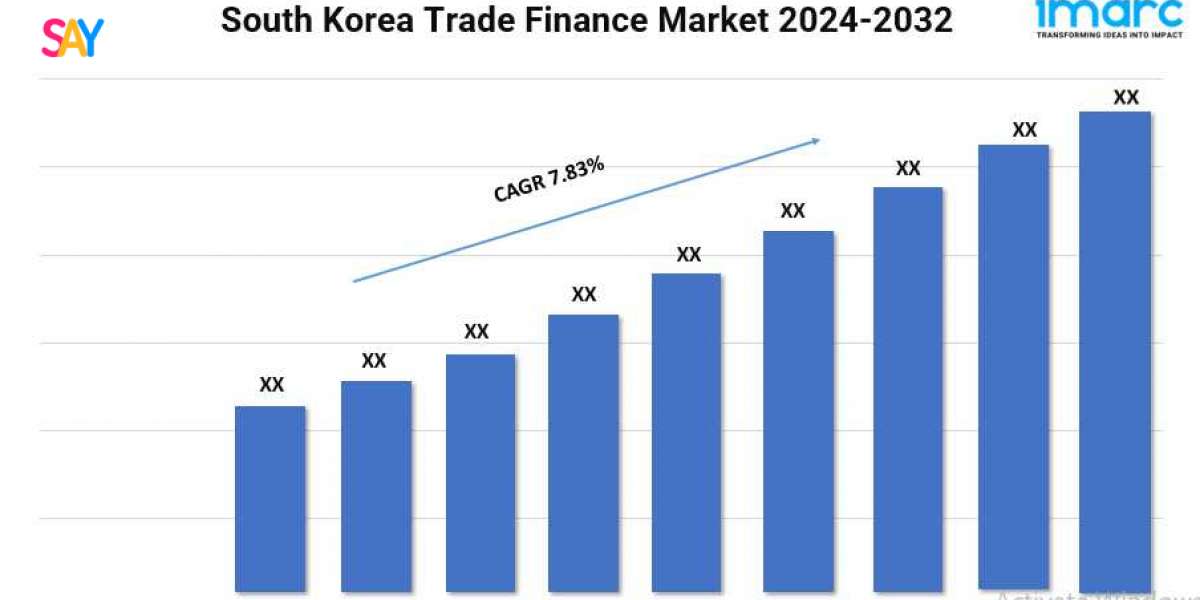

Base Year: 2023

Market Size in 2023: USD 1.3 Billion

Market Size in 2032: USD 2.2 Billion

Market Growth Rate: 5.80% (2024-2032)

The rising integration of blockchain technology and artificial intelligence (AI) into trade finance operations is streamlining processes, reducing transaction times, and enhancing security in South Korea. According to the latest report by IMARC Group, the South Korea trade finance market size is projected to exhibit a growth rate (CAGR) of 5.80% during 2024-2032.

South Korea Trade Finance Market Trends and Drivers:

The rising integration of blockchain technology and artificial intelligence (AI) into trade finance operations is streamlining processes, reducing transaction times, and enhancing security in South Korea. These technologies offer real-time tracking and transparency, which are highly valued in international trade. The support from the governing body for digital transformation, coupled with the innovation in the private sector, is bolstering the market growth in South Korea.

This digitalization is notably reducing costs associated with trade finance, making it more accessible to a broader range of businesses. Moreover, the adoption of electronic documents and e-signatures is further facilitating the seamless execution of trade finance transactions. In addition, financial institutions are offering products that support environment-friendly and socially responsible trade practices. The growing emphasis on green finance and sustainable development is encouraging financial institutions to integrate environmental, social, and governance (ESG) criteria into their trade finance offerings.

This trend aligns with the push for sustainable trade, attracting international investors and businesses that prioritize sustainability in their operations. Besides this, regulatory bodies are introducing measures to enhance the transparency and efficiency of trade finance transactions, which is instilling confidence among market participants. The commitment of the country to simplify trade finance procedures is encouraging greater participation from small and medium-sized enterprises (SMEs).

Furthermore, financial institutions in South Korea are developing new trade finance instruments that cater to the evolving needs of businesses. The introduction of supply chain finance is providing companies with more flexible and efficient financing options, enabling them to manage their working capital more effectively. Additionally, the development of digital trade platforms is facilitating the seamless execution of trade finance transactions, reducing the need for intermediaries and lowering transaction costs.

Apart from this, the implementation of a range of measures to simplify client procedures, enhance transparency, and improve the efficiency of trade logistics are contributing to the market growth in the country. These efforts include the adoption of advanced technologies for client processing, such as electronic data interchange (EDI) systems, which allow for faster and more accurate documentation handling. By reducing delays and minimizing the bureaucratic hurdles associated with international trade, these initiatives are making it easier for businesses to access trade finance and complete transactions efficiently.

South Korea Trade Finance Industry Segmentation:

Download sample copy of the Report: https://www.imarcgroup.com/south-korea-trade-finance-market/requestsample

The report has segmented the market into the following categories:

Service Provider Insights:

- Banks

- Trade Finance Companies

- Insurance Companies

- Others

Application Insights:

- Domestic

- International

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145