Having trouble with QuickBooks payroll not calculating taxes? You're not alone. This frustrating error can wreak havoc on your accounting processes and leave you scratching your head. But fear not because, in this blog, we'll explore why this error occurs and provide you with some effective solutions to fix it.

Whether you're a small business owner or a seasoned accountant, dealing with payroll tax calculation errors in QuickBooks payroll can be a real headache. The good news is that there are several common issues that you can troubleshoot and resolve to get your payroll taxes back on track. In this section, we'll explore some of the most frequently encountered problems with QuickBooks payroll tax calculations and set the stage for future solutions.

If you need prompt stepwise guidance to resolve the tax error in QuickBooks, then you can dial +1(800) 780-3064 and talk with a QuickBooks expert for detailed assistance.

Reasons Why QuickBooks Payroll May Not Be Calculating Taxes

There are several possible reasons why QuickBooks payroll may not be calculating taxes correctly. Getting an idea of the root cause of the issue is important to finding an accurate resolution. Let's take a closer look at some of the most common reasons behind this problem.

- One of the most common reasons for inaccurate tax calculations in QuickBooks payroll is outdated tax tables.

- The IRS and other tax authorities regularly update their tax rates and regulations, and if your QuickBooks payroll software isn't up-to-date with the latest information, it won't be able to calculate taxes accurately.

- This can happen if you haven't applied the latest payroll tax updates or if there's a problem with the automatic update process.

- Another potential cause of the tax calculation error is incorrect employee setup or payroll preferences. If the employee information in your QuickBooks payroll system is not accurate or up-to-date, it can lead to incorrect tax withholdings and payments.

- This could be due to issues with the employee's tax filing status, withholding allowances, or other personal information that affects their tax liability.

- Software conflicts and compatibility issues can also contribute to problems with QuickBooks payroll's tax calculation functionality.

- If you have other accounting or payroll software installed on your system, or if your QB payroll version is not compatible with your operating system or other software, it can cause glitches and errors in the tax calculation process.

Another similar issue is QuickBooks not calculating unemployment correctly. Follow the subsequent section to learn about the resolutions.

Troubleshooting Steps to Fix Payroll Tax Calculation Error

Now that we've identified some of the common reasons why QuickBooks payroll may not be calculating taxes correctly, let's dive into the troubleshooting steps you can take to fix the issue. By following these steps, you'll be able to identify the root cause of the problem and implement the appropriate solution to get your payroll taxes back on track.

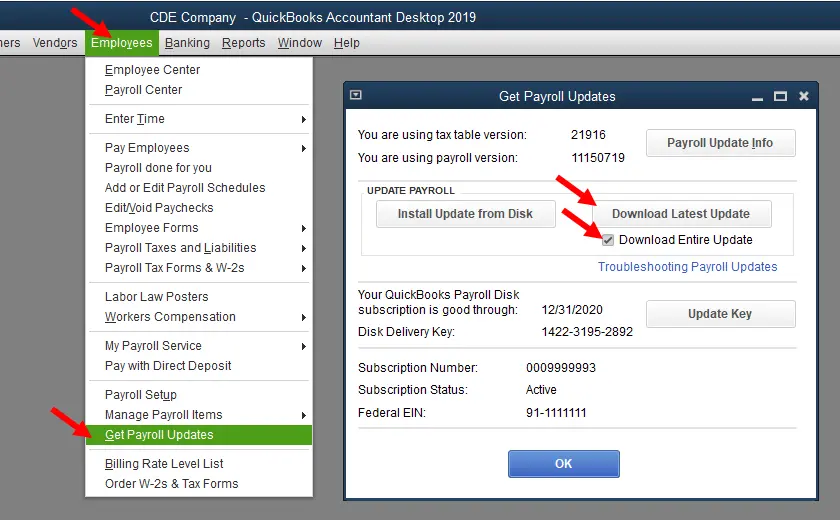

Updating QuickBooks Payroll Tax Tables

One of the most common reasons for inaccurate tax calculations in QuickBooks payroll is outdated tax tables. As mentioned earlier, the IRS and other tax authorities regularly update their tax rates and regulations, and if your QuickBooks payroll software isn't keeping up with these changes, it won't be able to calculate taxes accurately.

- Fortunately, updating your QuickBooks payroll tax tables is a relatively straightforward process.

- To do this, simply go to the "Payroll" menu in QuickBooks.

- Select "Update Tax Tables".

- Then, follow the on-screen instructions. This will ensure that your QuickBooks payroll software has the latest tax information and can accurately calculate your payroll taxes.

It's important to note that the tax table update process may take some time, especially if you're updating multiple tax tables or have many employees. During this time, avoid running payroll to ensure accurate tax calculations. Once the update is complete, you can proceed with your regular payroll processing with confidence that your taxes are correctly calculated.

Verifying Employee Setup and Payroll Preferences

Another common cause of QuickBooks payroll tax calculation errors is incorrect employee setup or payroll preferences. If the employee information in your QuickBooks Payroll system is not accurate or up-to-date, it can lead to incorrect tax withholdings and payments.

- To ensure that your employee setup and payroll preferences are correct, start by reviewing the information for each employee in your QuickBooks payroll system.

- Check that their tax filing status, withholding allowances, and other personal details are accurate and up-to-date. If you find any discrepancies, make the necessary corrections to ensure that the tax calculations are accurate.

- In addition to verifying employee information, you'll also want to review your payroll preferences to ensure that they're configured correctly for your business and local tax requirements. This includes settings like tax rates, withholding percentages, and payment schedules.

- By taking the time to review and update your employee setup and payroll preferences thoroughly, you can help ensure that your QuickBooks payroll system is accurately calculating your payroll taxes. This will not only save you time and headaches in the long run but also help you avoid potential issues with the IRS or other tax authorities.

Conclusion

In conclusion, the QuickBooks payroll tax calculation error can be a frustrating and complex issue to resolve, but by following the troubleshooting steps outlined in this blog post, you can get your payroll taxes back on track quickly and efficiently. If you need further assistance, you can connect with QB experts and get professional guidance.

Read more:- Fix QuickBooks Error PS038 Due to Damaged Network Data Files