The United States electronic logging devices (ELDs) market size in the has witnessed substantial growth in recent years, driven by regulatory mandates, technological advancements, and a growing emphasis on fleet management efficiency. As of 2023, the market size stood at approximately USD 4.89 billion, and it is expected to expand at a CAGR of 4.8% from 2024 to 2032, reaching a value of around USD 7.55 billion by 2032. This growth is indicative of the increasing adoption of ELDs across various industries and the evolving landscape of transportation and logistics.

Key Benefits of ELDs

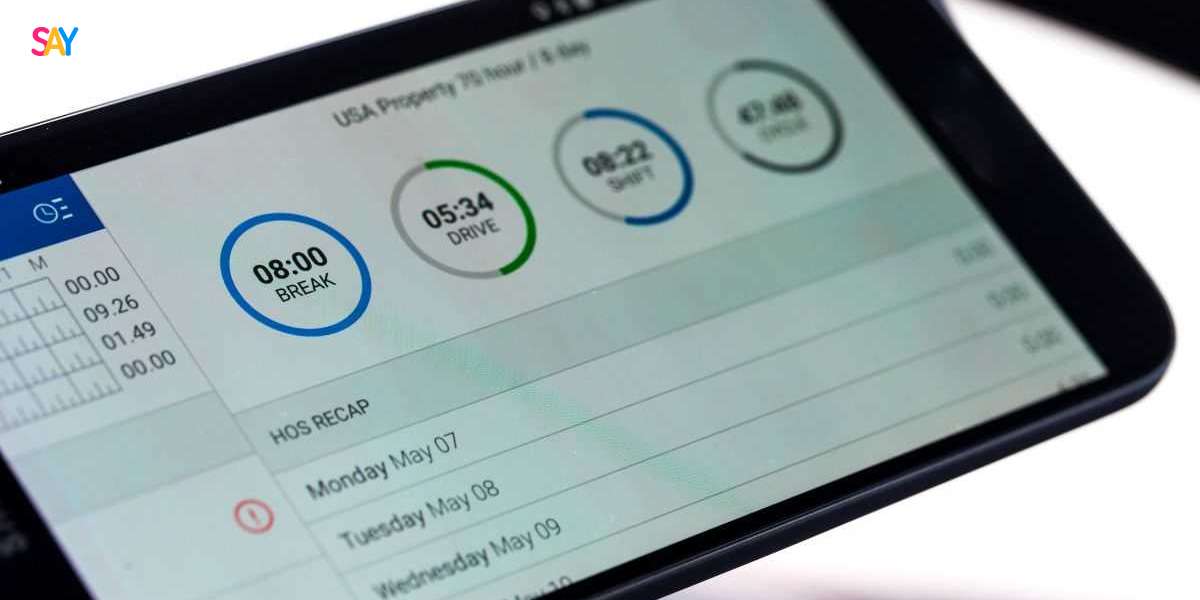

ELDs offer several key benefits to fleet operators, drivers, and regulatory bodies. One of the primary advantages is improved compliance with hours of service (HOS) regulations, ensuring that drivers adhere to legal driving limits and rest requirements. This not only helps in reducing the risk of accidents due to driver fatigue but also enhances overall road safety.

Additionally, ELDs enable better fleet management through real-time tracking of vehicles, leading to enhanced operational efficiency and reduced fuel consumption. They also facilitate accurate recording of driver logs, simplifying administrative tasks and reducing paperwork. Moreover, ELDs provide valuable data insights that can be leveraged for optimizing routes, reducing idle time, and improving driver performance.

Key Industry Developments

The ELD market in the United States has witnessed significant developments in recent years, driven by advancements in technology and regulatory changes. One of the notable developments is the integration of ELDs with telematics and fleet management systems, enabling fleet operators to streamline their operations and improve overall efficiency.

Moreover, the market has seen the emergence of cloud-based ELD solutions, offering enhanced flexibility and scalability. These solutions allow for seamless integration with other business systems, providing a comprehensive view of fleet operations. Additionally, the market has witnessed increased adoption of ELDs in various industries beyond transportation, including construction, oil and gas, and utilities.

Driving Factors

Several factors are driving the growth of the ELD market in the United States. One of the primary drivers is the regulatory mandate set forth by the Federal Motor Carrier Safety Administration (FMCSA), requiring commercial motor vehicle drivers to use ELDs to record their hours of service. This mandate, aimed at improving road safety and reducing driver fatigue, has led to widespread adoption of ELDs across the country.

Additionally, the increasing focus on fleet management efficiency and optimization is driving the demand for ELDs. Fleet operators are increasingly looking for ways to reduce costs, improve driver productivity, and enhance overall operational efficiency, driving the adoption of ELDs.

COVID-19 Impact

The COVID-19 pandemic has had a mixed impact on the ELD market in the United States. While the initial lockdowns and restrictions led to a slowdown in transportation activity, the market quickly rebounded as the economy reopened. The pandemic has underscored the importance of efficient fleet management and compliance with HOS regulations, driving the adoption of ELDs.

Restraining Factors

Despite the growth opportunities, the ELD market in the United States faces several challenges. One of the key challenges is the initial cost of implementing ELDs, which can be significant for small and medium-sized fleet operators. Additionally, there are concerns about data privacy and security, as ELDs collect sensitive information about drivers and vehicles.

Market Segmentation

The ELD market in the United States can be segmented based on type, connectivity, vehicle type, and end-use industry. By type, the market can be divided into dedicated ELDs and integrated ELDs. Dedicated ELDs are standalone devices, while integrated ELDs are part of a larger telematics or fleet management system.

By connectivity, the market can be segmented into cellular and satellite-based ELDs. Cellular ELDs use cellular networks to transmit data, while satellite-based ELDs use satellite networks for connectivity. Vehicle type segmentation includes light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs).

Market Outlook and Trends

The ELD market in the United States is expected to witness steady growth in the coming years, driven by regulatory mandates, technological advancements, and the growing demand for fleet management solutions. One of the key trends in the market is the integration of ELDs with advanced telematics and fleet management systems, enabling real-time tracking and monitoring of vehicles.

Industry Segmentation

The ELD market in the United States serves a wide range of industries, including transportation and logistics, construction, oil and gas, utilities, and others. Each industry has unique requirements and challenges, driving the demand for customized ELD solutions.

Regional Analysis

The United States is a major market for ELDs, driven by stringent regulatory requirements and a large fleet of commercial vehicles. The market is concentrated in regions with high transportation activity, such as the Midwest, Southeast, and West Coast.

Analysis and News

Recent developments in the ELD market include partnerships and collaborations among key players to enhance their product offerings and expand their market presence. Additionally, advancements in technology, such as the integration of ELDs with artificial intelligence (AI) and machine learning (ML) algorithms, are expected to drive further growth in the market.

Top Impacting Factors

The top factors impacting the ELD market in the United States include regulatory mandates, technological advancements, market competition, and economic conditions. Regulatory mandates, such as the FMCSA's ELD mandate, are driving the adoption of ELDs, while technological advancements are enabling innovative solutions to meet the evolving needs of fleet operators.

Target Audience

The target audience for ELDs includes fleet operators, transportation companies, logistics providers, regulatory bodies, and technology providers. Fleet operators are the primary users of ELDs, as they help in improving operational efficiency and compliance with regulatory requirements.

Sub-Categories: Food and Beverages, Sweeteners

In the food and beverages industry, ELDs play a crucial role in ensuring the timely and safe delivery of goods. By tracking vehicles in real-time and monitoring driver behavior, ELDs help in optimizing routes, reducing delivery times, and ensuring compliance with food safety regulations.

In the sweeteners industry, ELDs are used to monitor the transportation of sweeteners from production facilities to distribution centers. By providing real-time visibility into the location and condition of shipments, ELDs help in reducing the risk of spoilage and ensuring the quality of products.

Major Key Players

Some of the major players in the ELD market in the United States include:

Trimble Inc.

Omnitracs, LLC

Teletrac Navman Ltd.

Geotab Inc.

Donlen Corporation

Garmin Ltd.

Others

Opportunities

The ELD market in the United States offers several opportunities for growth and innovation. One of the key opportunities is the integration of ELDs with emerging technologies such as AI, ML, and the Internet of Things (IoT) to provide advanced analytics and predictive insights.

Additionally, the market is witnessing increased demand for ELDs with advanced features such as driver coaching, predictive maintenance, and fuel efficiency monitoring. Fleet operators are increasingly looking for solutions that not only help them comply with regulatory requirements but also enhance their overall operational efficiency.

Challenges

Despite the growth opportunities, the ELD market in the United States faces several challenges. One of the key challenges is the complexity of regulatory compliance, as fleet operators need to ensure that their ELDs comply with the latest regulations and standards.

Additionally, there are concerns about data privacy and security, as ELDs collect sensitive information about drivers and vehicles. Fleet operators need to implement robust security measures to protect this data from unauthorized access and cyber threats.

Scope

The scope of the ELD market in the United States is vast, encompassing a wide range of industries and applications. As regulatory mandates become more stringent and the demand for fleet management solutions grows, the market is expected to witness steady growth in the coming years.

The ELD market in the United States is poised for significant growth, driven by regulatory mandates, technological advancements, and the growing demand for fleet management solutions. With the right strategies and investments, players in the market can capitalize on the opportunities and overcome the challenges to drive innovation and growth in the industry.