How Virtual Credit Cards Work

Virtual credit cards, also known as digital or disposable credit cards, are essentially temporary credit card numbers generated for single-use or limited transactions. These cards are typically issued by major credit card companies or financial institutions and are linked to the user's primary credit card account.

When making a purchase online, instead of using your actual credit card number, you can use the virtual credit card number provided by your issuer. This adds an extra layer of security as the virtual card number is separate from your physical card details.

Advantages of Virtual Credit Cards

Virtual credit card offer several advantages, including enhanced security, privacy, and control over your finances. Since these cards are temporary and often have spending limits, they are less susceptible to fraud and unauthorized transactions.

Moreover, virtual credit cards can be easily generated and used for specific purposes, such as online shopping, subscription services, or travel bookings. They also provide an additional level of privacy by masking your actual credit card details from merchants.

Security Features of Virtual Credit Cards

One of the primary reasons why virtual credit cards are gaining popularity is their robust security features. These cards are designed to protect users against identity theft, online fraud, and unauthorized charges.

Most virtual credit card providers offer features like single-use card numbers, spending limits, and transaction alerts. Additionally, some issuers allow users to set expiration dates for their virtual cards, further reducing the risk of misuse.

Limitations of Virtual Credit Cards

While virtual credit cards offer numerous benefits, they also have some limitations. For instance, not all merchants accept virtual card payments, which can limit their usability in certain situations.

Furthermore, virtual credit cards may not be suitable for long-term or recurring payments, such as utility bills or loan repayments. Additionally, since these cards are digital, they are vulnerable to technical glitches, internet connectivity issues, or hacking attempts.

How to Get a Virtual Credit Card

Obtaining a virtual credit card is relatively simple, as many banks and financial institutions offer this service to their customers. To get started, you can inquire with your bank about their virtual card offerings and the application process.

In most cases, you will need to sign up for online banking or mobile banking services and request a virtual credit card through the bank's website or mobile app. Once approved, you can generate virtual card numbers as needed for your online transactions.

Popular Virtual Credit Card Providers

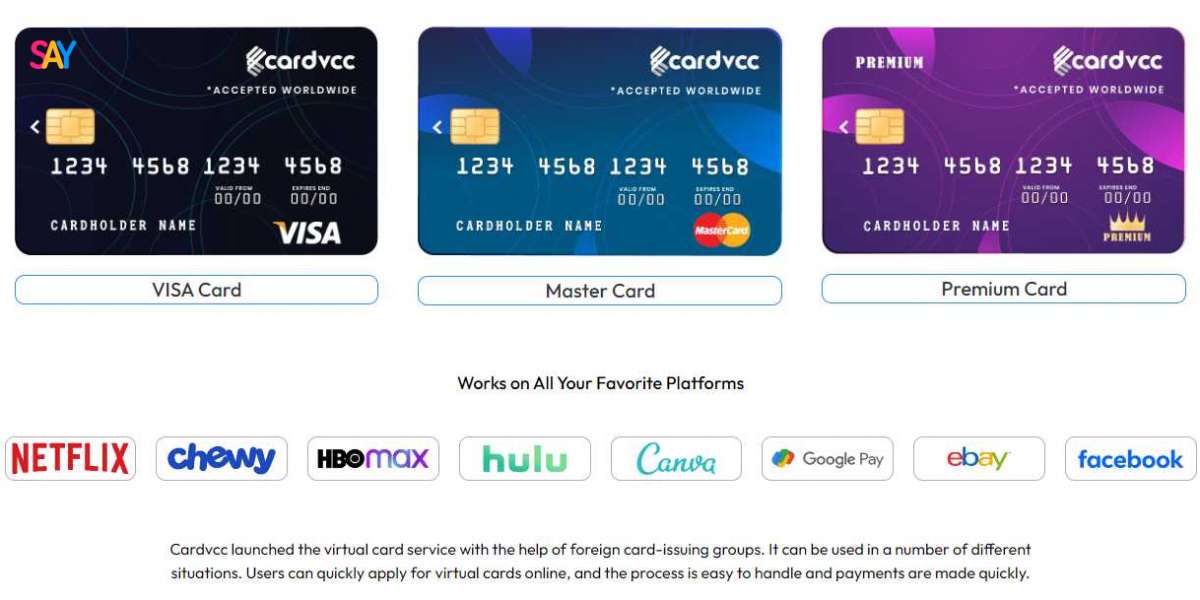

Several companies specialize in providing virtual credit card services to consumers. Some of the most popular virtual credit card providers include Privacy, Blur, and Capital One Eno.

These providers offer a range of features and benefits, including customizable spending limits, transaction monitoring, and virtual card management tools. Users can choose the provider that best suits their needs and preferences.

Using Virtual Credit Cards for Online Shopping

One of the primary uses of virtual credit cards is for online shopping. By using a virtual card number instead of your actual credit card details, you can protect your sensitive information from being compromised in case of a data breach or security breach.

Moreover, virtual credit cards can help prevent unauthorized charges or fraudulent transactions, as each card number is unique and tied to a specific purchase or merchant.

Virtual Credit Cards for Subscription Services

Another practical application of virtual credit cards is for managing subscription services. Many consumers use virtual cards to sign up for free trials or subscription-based services without having to worry about canceling recurring payments.

By using a virtual card with a predetermined spending limit, users can ensure that they are not charged beyond their intended usage or subscription period. This adds an extra layer of control and flexibility to managing recurring expenses.

Virtual Credit Cards for Travel

Virtual credit cards can also be useful for travelers, especially when making bookings or reservations online. By using a virtual card number, travelers can protect their primary credit card details from being exposed to potential fraud or theft.

Additionally, some virtual credit card providers offer travel-specific features, such as currency conversion, travel insurance, or rewards programs. This makes virtual cards an attractive option for frequent travelers looking for added security and convenience.

Virtual Credit Cards for Privacy Protection

Privacy protection is another key benefit of using virtual credit cards. By generating a unique card number for each transaction, users can minimize the risk of their personal or financial information being compromised.

Virtual credit cards are particularly useful for safeguarding against online identity theft, phishing scams, or malicious websites. Since the card number is temporary and disposable, it cannot be used for unauthorized purposes once the transaction is completed.

Virtual Credit Cards vs. Traditional Credit Cards

When comparing virtual credit cards to traditional credit cards, there are several differences to consider. While traditional credit cards offer greater flexibility and acceptance, they also pose higher risks in terms of security and privacy.

Virtual credit cards, on the other hand, provide a more secure and controlled way to make online transactions, albeit with some limitations in terms of acceptance and usability. Ultimately, the choice between virtual and traditional credit cards depends on the user's preferences and priorities.

Tips for Using Virtual Credit Cards Safely

To maximize the benefits of virtual credit cards and minimize the risks, here are some tips to keep in mind:

- Regularly monitor your virtual card transactions for any unauthorized charges or suspicious activity.

- Avoid sharing your virtual card details with unfamiliar or untrustworthy websites.

- Set spending limits and expiration dates for your virtual cards to reduce the risk of misuse.

- Use strong, unique passwords and enable two-factor authentication for added security.

- Keep your virtual card information secure and avoid storing it in easily accessible locations or devices.

Future Trends in Virtual Credit Cards

As technology continues to evolve, we can expect virtual credit cards to become even more advanced and widely adopted in the future. With the rise of mobile payments, biometric authentication, and blockchain technology, virtual cards are poised to become the preferred choice for secure and convenient online transactions.

Moreover, as consumers become more aware of the risks associated with traditional credit cards, the demand for virtual credit card solutions is likely to increase. This, in turn, will drive innovation and competition among virtual card providers, leading to better features and benefits for users.

Conclusion

In conclusion, virtual credit cards offer a safe, convenient, and versatile way to conduct online transactions in today's digital age. With their enhanced security features, privacy