Report Overview:

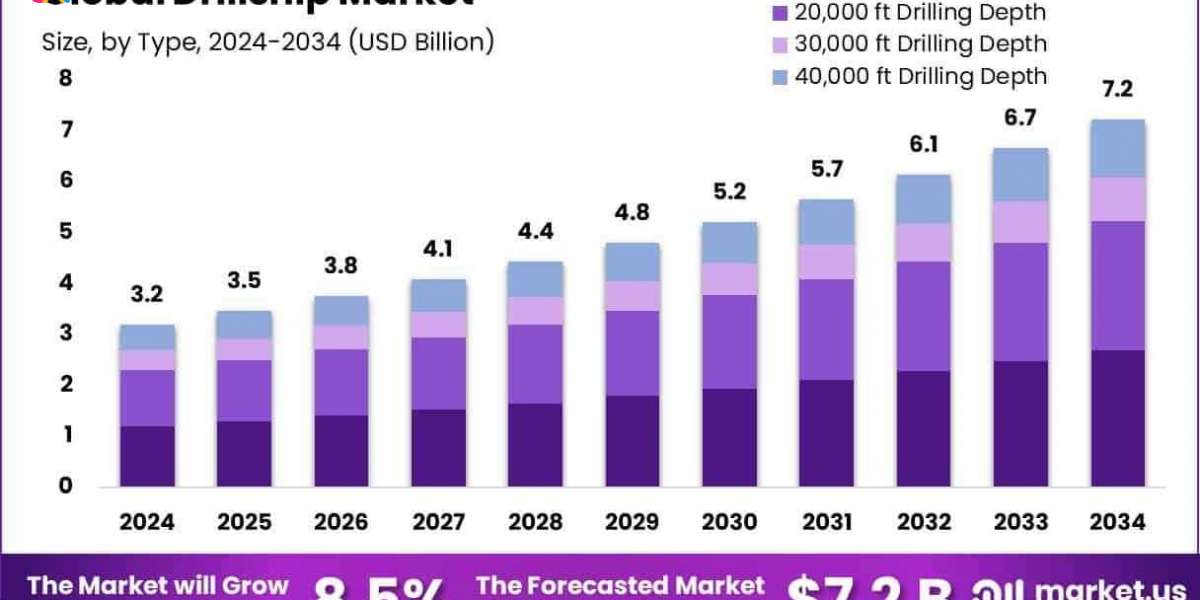

The global drillship market is on a strong upward trajectory, with its value almost doubling from about USD 3.2 billion in 2024 to a projected USD 7.0 billion by 2034. This impressive surge reflects a compound annual growth rate (CAGR) of around 8.5%.

Drillships are advanced offshore vessels, equipped with dynamic positioning systems and satellite navigation, enabling them to drill in deep and ultra-deepwater environments. These assets are increasingly vital as energy companies push into untapped areas like the Arctic and other remote offshore zones where onshore drilling can’t reach. Their versatility extends beyond exploration they handle well maintenance, completions, and even subsea operations making them a cornerstone of modern offshore drilling strategies .

Growth in the drillship market is being fueled by improved drilling technology, a renewed focus on deepwater and ultra-deepwater projects, and steady increases in global oil demand. In 2024 alone, drillships capable of reaching 20,000 ft depths accounted for over 37% of the market.Deepwater projects made up almost half (about 49%) of all applications, supported by innovations in subsea systems .

Key Takeaways:

- The global drillship market was valued at USD 3.2 billion in 2024.

- The global drillship market is projected to grow at a CAGR of 8.5% and is estimated to reach USD 7 billion by 2034.

- Among by type (drilling depth), 20,000 ft. drilling depth accounted for the largest market share of 37.2 %, due to their extensive use in deep regions.

- By application, deep water accounted for the largest market share of 49.3%, driven by ongoing advancements in drilling technologies and subsea systems.

- By end-use, oil and gas exploration accounted for the majority of the market share at 58.2%, driven by high demand and untapped reserves in deep and ultra-deepwater regions.

- North America is estimated as the largest market for drillship with a share of 37.9% of the market share, driven by region robust untapped resources in deep regions with government incentives for energy exploration.

![]()

Download Exclusive Sample Of This Premium Report:

https://market.us/report/drillship-market/free-sample/

Key Market Segments:

By Type

- 10,000 ft Drilling Depth

- 20,000 ft Drilling Depth

- 30,000 ft Drilling Depth

- 40,000 ft Drilling Depth

By Application

- Shallow Water

- Deep Water

- Ultra-deepwater

By End-use

- Oil Gas Exploration

- Oil Gas Production

- Deep-sea Mining

Drivers:

One of the core drivers of the global drillship market is the accelerating demand for offshore oil and gas exploration, especially in deepwater and ultra-deepwater regions. As shallow water and onshore reserves decline, oil companies are expanding into deeper offshore basins that require advanced drilling capabilities.

Drillships offer unmatched mobility, can drill in waters over 10,000 feet deep, and operate in remote, harsh environments. These features are critical for exploration campaigns in areas such as the Gulf of Mexico, West Africa, Brazil, and the Eastern Mediterranean. The combination of mobility, depth capability, and technological integration makes drillships the preferred asset for many offshore projects.

Another major driver is the improvement in drillship technology. Modern vessels are now equipped with dynamic positioning systems, real-time data monitoring, dual-activity systems, and improved safety protocols, making them more efficient and reliable. These advancements help reduce downtime, improve drilling precision, and lower the total cost per well.

Additionally, supportive regulatory policies in key producing countries and increasing investments from national oil companies have further fueled market expansion. As energy security becomes a global priority, the strategic importance of offshore drilling assets like drillships will only continue to grow.

Opportunities:

One of the most promising opportunities in the drillship market lies in ultra-deepwater drilling. With technology now enabling operations at depths exceeding 12,000 feet, vast untapped reserves in deep basins are becoming commercially viable. Countries with frontier exploration zones, such as those in the Arctic, South America, and parts of Asia-Pacific, present long-term opportunities for drillship operators.

Additionally, as environmental concerns push for more sustainable practices, there’s growing interest in upgrading fleets with energy-efficient engines and hybrid systems. Companies that can adapt their fleets to meet these demands may find themselves ahead of the curve and more attractive to international clients.

Another strong opportunity exists in fleet modernization and digital transformation. Many older drillships are reaching the end of their service lives, which opens the door for new, high-spec vessels to enter the market. Investments in automation, predictive maintenance through IoT, and enhanced cybersecurity protocols are becoming industry norms.

Operators who adopt such technologies not only improve operational efficiency but also increase safety and reduce risk exposure. Furthermore, partnerships with digital solution providers and software platforms for remote drilling operations create a new segment of service-based revenue. This shift toward smarter operations positions drillship companies to expand both technologically and geographically.

Restraints:

A significant risk facing the drillship market is volatility in global oil prices. Deepwater drilling is capital-intensive, with long project timelines and substantial upfront investment. If oil prices fall below breakeven levels, exploration companies may postpone or cancel projects, directly affecting demand for drillship services.

The market has witnessed this in the past during downturns, where utilization rates for drillships dropped sharply. Even when prices are stable, inflation in equipment, labor, and insurance costs can erode profit margins. For many operators, a small disruption in day rates or contract delays can create large financial gaps, particularly for those with high debt loads or older fleets.

Additionally, geopolitical instability poses a growing risk. Drillship operations often occur in politically sensitive regions with a history of conflict or regulatory unpredictability. Changes in government policies, export restrictions, sanctions, or regional conflicts can delay or halt offshore activities.

Moreover, securing permits for offshore exploration has become more challenging in several countries due to environmental activism and stricter compliance frameworks. These uncertainties make long-term planning more difficult and increase the cost and complexity of operating in multiple jurisdictions. As a result, companies must factor in political risk insurance and develop robust contingency plans for international operations.

Trends:

One of the most long-term threats to the drillship market is the global shift toward renewable energy. As nations pledge to reduce their carbon footprints and transition toward cleaner energy sources, oil and gas exploration is coming under increased scrutiny. This could result in reduced government support for offshore projects or stricter emission regulations for offshore fleets.

If alternative energy sources continue to become more cost-competitive, investor interest in fossil fuel projects could decline, affecting funding for new offshore developments. In the long run, this could shrink the customer base for drillship services, especially if global energy consumption patterns begin to shift more decisively toward solar, wind, and hydrogen.

Another emerging threat comes from operational challenges in extreme environments. Drillships often operate in regions prone to hurricanes, icebergs, or underwater seismic activity. These hazards not only increase safety risks but also result in higher insurance premiums, logistical complications, and possible delays.

Furthermore, cyber threats have become a serious concern as modern drillships rely heavily on software and interconnected control systems. A breach in cybersecurity can lead to operational failures, safety breaches, and reputational damage. Combined with increasing maintenance costs for older ships and stricter compliance requirements, these operational threats demand proactive mitigation strategies from all industry stakeholders.

Market Key Players:

- P. Møller – Mærsk A/S

- Bureau Veritas Marine Offshore

- CBO Holding S.A.

- China Shipbuilding Group

- Cosco Shipping Lines Co., Ltd.

- Daewoo Shipbuilding Marine Engineering

- Diamond Offshore Drilling

- Finctierani-Cantieri Navali Italiani

- Hanjin Heavy Industries and Construction

- Hyundai Heavy Industries

- Hyundai Mipo Dockyard

- JSC Kherson Shipyard

- Kawasaki Kisen Kaisha, Ltd.

- Maersk Drilling

- Mitsubishi Heavy Industries

- Ocean Rig

- Samsung Heavy Industries Co., Ltd.

- Seadrill Limited

- Sembcorp Marine Ltd.

- Siem Offshore Inc.

- Stena Drilling

- STX Shipbuilding

- Transocean Ltd

- Valaris Limited

- Wärtsilä Corporation

- Others

Conclusion: