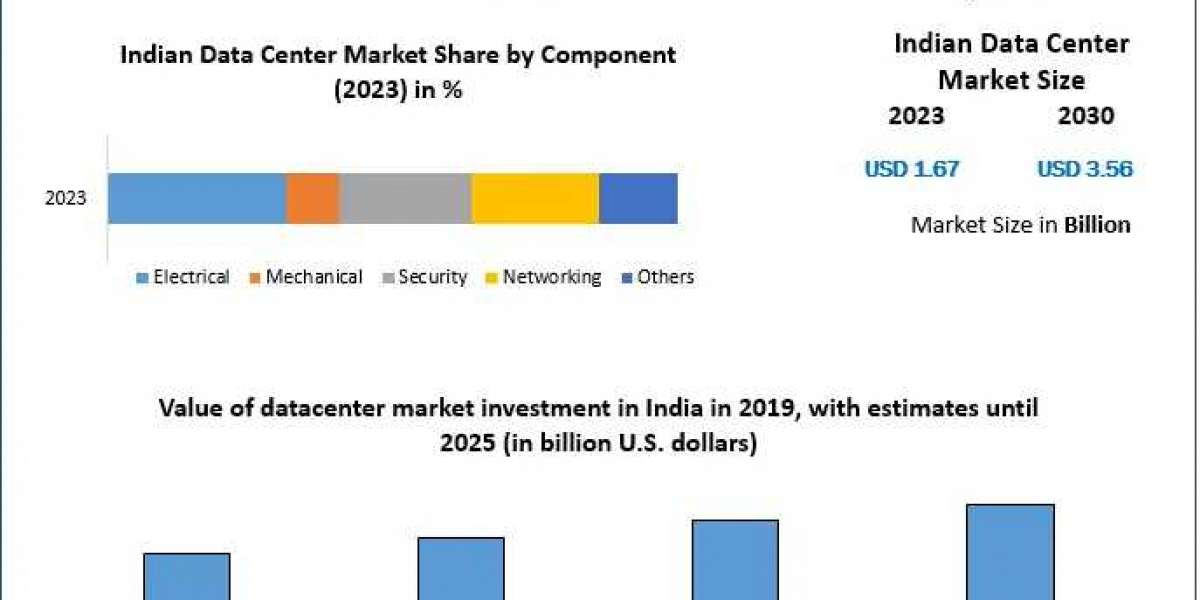

India’s Data Center Market on a Digital Ascent: Projected to Reach USD 3.56 Billion by 2030

India is undergoing a profound digital transformation, and at the core of this revolution lies the rapidly expanding data center market. Valued at USD 1.67 billion in 2023, the Indian Data Center Market is set to reach a remarkable USD 3.56 billion by 2030, growing at a steady CAGR of 11.4% during the forecast period. This growth reflects India's rising dependence on data-driven technologies, cloud computing, and digital services across industries.

A Foundation Built on Digital Ambitions

A data center is no longer just a physical structure for storing servers—it’s the digital backbone of modern enterprise operations. India's expanding reliance on cloud infrastructure, AI, IoT, and big data analytics is creating an insatiable demand for high-performance, scalable, and energy-efficient data centers.

Traditionally concentrated in metro cities, the market is now rapidly expanding to tier-2 and tier-3 cities, driven by regional connectivity requirements and digital inclusion programs.

Unlock key market insights by accessing the sample report through the link .@https://www.maximizemarketresearch.com/request-sample/29762/

Current Landscape and Geographical Clustering

India’s data center landscape remains dominated by Mumbai, Chennai, Delhi, and Bengaluru, which account for more than 75% of total IT load capacities and 60% of data center sites. Among these, Mumbai leads with over 50% market share, emerging as Asia-Pacific’s third-largest data center hub by 2023.

Yet, this urban concentration also creates demand-supply imbalance and land constraints, pushing investors to explore secondary markets. As India adds more than 880 million internet users into its digital ecosystem, demand for edge data centers and regional hubs is gaining traction.

Market Drivers: Technology Meets Policy

1. Accelerated Digital Transformation

Fueled by mass smartphone penetration, UPI transactions, remote work models, and a booming start-up ecosystem, India's digital economy is evolving at breakneck speed. Cloud adoption by businesses, government initiatives like Digital India, and surging demand for OTT platforms are directly contributing to data center expansion.

2. Global Cloud Providers Enter the Market

Global giants such as AWS, Equinix, Digital Realty, and NTT Ltd are either entering or expanding their presence in India, investing in hyperscale facilities. In January 2024, Digital Realty launched its first Indian data center in Chennai, capable of supporting up to 100 MW of critical IT load—a strategic move to serve India's growing enterprise cloud and colocation demands.

3. Government Push and Regulatory Support

The Indian government’s proactive stance through the Draft Data Center Policy 2020 promotes the domestic manufacturing of data center equipment and offers infrastructure status to data centers. Incentives for land acquisition, power supply, and sustainable energy usage are also being promoted.

4. Sustainable Data Center Growth

Sustainability is a critical concern. Players such as Colt DCS and Vertiv are committing to net-zero carbon operations. Vertiv's recent expansion with a new manufacturing facility in India underlines its goal to produce thermal management solutions for energy-efficient centers.

Challenges and Constraints

- Infrastructure Bottlenecks

India’s energy infrastructure and real estate ecosystem are still catching up with the rapid rise in data center demand. Availability of reliable, round-the-clock power and large parcels of land in urban cores remains a limiting factor.

- Energy Consumption and Environmental Concerns

Power consumption from Indian data centers is projected to reach 5 gigawatts over the next 6–7 years, raising concerns around sustainability, power sourcing, and carbon emissions. There is growing pressure to integrate renewable energy into the power mix and reduce environmental impact.

Opportunities: Real Estate, Manufacturing Renewable Integration

- Real Estate Expansion

More than 500 acres of land were acquired in 2022 alone for building new data centers. By 2025, the total data center footprint is expected to double from 10.3 million sq. ft. to 20 million sq. ft., creating a parallel construction and real estate boom.

- Domestic Manufacturing

The Draft Data Center Policy encourages local manufacturing of both IT and non-IT components—ranging from servers to cooling units. This initiative is also aimed at reducing dependency on imports and strengthening India’s technological autonomy.

- Green Energy Captive Power Plants

With global climate goals in focus, the Indian data center sector is investing in renewable energy sources. Captive solar and wind plants, hybrid energy models, and carbon offset initiatives are being explored to enable eco-friendly growth.

Segment Analysis

By Industry Vertical

IT Telecom leads the market due to its high demand for bandwidth, data storage, and connectivity. Telecom data centers require robust regional and edge computing infrastructure to serve growing mobile and cloud users.

Other high-growth segments include BFSI, Retail, Manufacturing, Media, and Government, where digital applications are becoming integral to service delivery.

By Component

Electrical Systems hold the largest market share. These include UPS systems, power distribution units (PDUs), and emergency power solutions, all critical for uninterrupted data center operations.

Other components include mechanical (cooling, ventilation), networking (switches, routers), and security systems (biometrics, surveillance)—each playing a vital role in ensuring uptime and data integrity.

Unlock Exclusive Market Insights with a Single Click @https://www.maximizemarketresearch.com/request-sample/29762/

Key Players Driving Market Expansion

The Indian data center market is highly competitive, with both domestic and global players actively investing in infrastructure, partnerships, and technology innovations. Notable names include:

Sify Technologies

Web Werks

CtrlS Datacenters Ltd

ESDS Software Solution Ltd

Yotta Infrastructure

Netmagic Solutions (NTT)

AWS (Amazon Web Services)

Gpx Global Systems

NxtGen

Nxtra (Bharti Airtel)

Reliance

STT GDC India

Tata Communications

Equinix

RackBank Datacenters Pvt. Ltd.

COLT DCS

Vertiv

AdaniConneX

These players are investing in edge data centers, modular infrastructure, and AI-powered monitoring tools to enhance efficiency, performance, and scalability.

Future Outlook: A Data-Driven India

India's data center market is not just expanding—it’s transforming. With a projected market value of USD 3.56 billion by 2030, the country is poised to become a major data hub in the Asia-Pacific region. This evolution is powered by a combination of policy support, digital adoption, renewable integration, and rising enterprise demand.

As the economy continues to digitize, the role of secure, scalable, and sustainable data centers will become more critical than ever. Companies that invest early in localized infrastructure, energy efficiency, and talent development will be best positioned to lead in this high-growth arena.