Report Overview:

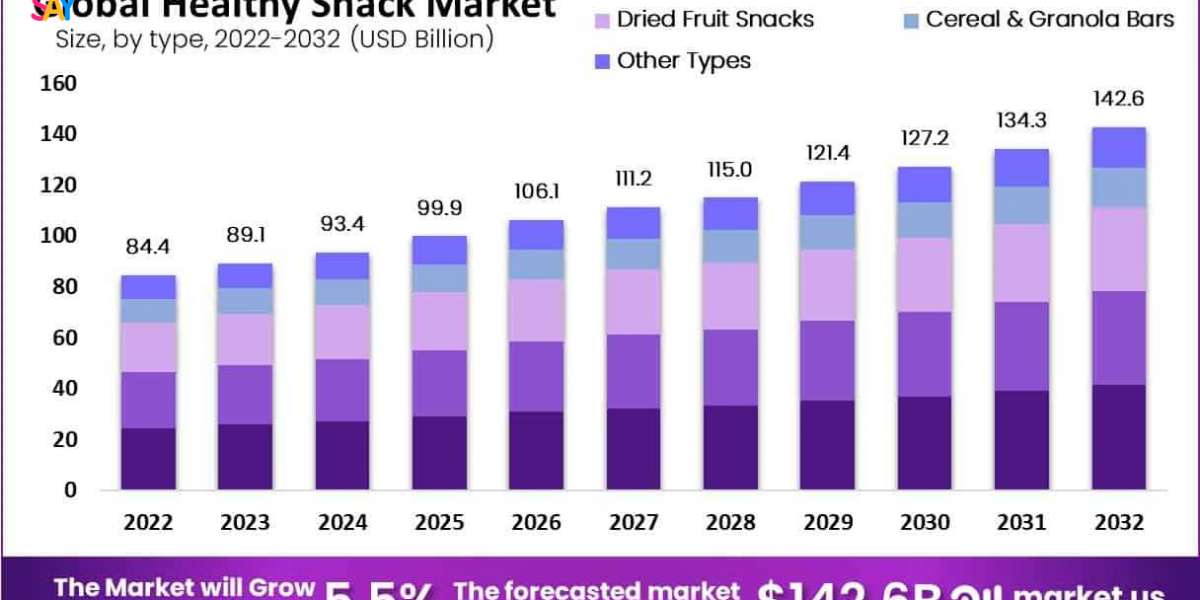

The global healthy snack market is witnessing consistent growth, expanding from around USD 89.1 billion in 2023 to an anticipated USD 142.6 billion by 2032, progressing at a 5.5% CAGR. This rise highlights a shift in consumer preferences toward snacks that are both nutritious and convenient to consume.

Key Takeaways

Steady growth: The market is projected to grow from USD 89.1 billion in 2023 to USD 142.6 billion by 2032, with a consistent 5.5% CAGR.

Leading categories: "Nuts, seeds trail mixes" topped the list in 2023 with USD 24.5 billion and are projected to reach USD 41.4 billion by 2032. Other popular items include meat snacks, dried fruits, and granola bars.

Sales channels: Hypermarkets and supermarkets account for the largest market share (31–44%), followed by convenience stores (27%), specialty shops (18%), and online retailers (14%).

Shifting preferences: Consumers are prioritizing ease and health—91% placed convenience as a top factor in 2021, and 72% now prefer snacks that come in portion-controlled packs (up from 63%).

Sample Report Request For More Trending Reports:

https://market.us/report/healthy-snack-market/free-sample/

Key Market Segments

Based on Type

- Frozen Refrigerated

- Fruit, Nuts and Seeds

- Bakery

- Savory

- Bars and Confectionery

- Dairy

- Others

By Packaging

- Bag Pouches

- Boxes

- Cans

- Jars

- Others

Based on Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Other Distribution Channels

Growth Opportunity

Clean-label innovation: Consumers increasingly favor transparent ingredient lists and smaller, healthier portions.

Digital evolution: Direct-to-consumer models and e-commerce growth are reshaping the snack-buying experience.

Developing regions: With increasing income levels, emerging markets are poised for strong healthy snack adoption.

Functional focus: Snacks that offer added health benefits—like high-protein or gut-friendly formulas—are in high demand.

Latest Trends

Controlled portions: A growing number of consumers (72%) now choose portioned snacks for health and convenience.

On-the-go packaging: Demand is increasing for grab-and-go options like bars and resealable packs.

Natural ingredients: Preference is shifting toward snacks with minimal processing and clean labels.

Hybrid shopping habits: Pandemic-influenced buying behavior favors a blend of physical and online shopping—74% expect flexible options.

Market Key Players

- PepsiCo Inc.

- Nestle S.A.

- Unilever PLC

- Tyson Foods Inc.

- Kellogg Company

- B G Foods Inc.

- Mondelēz International

- Harvest Almond Snacks

- Happytizers Pvt Ltd

- Other Key Players