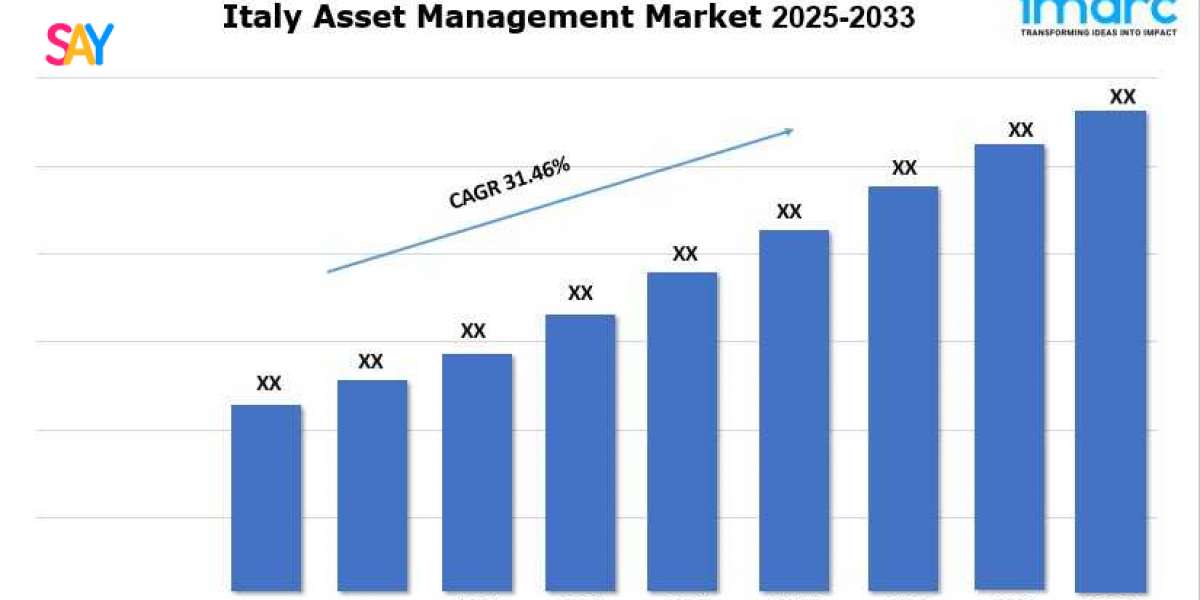

Italy Asset Management Market Overview

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Italy Asset Management Industry Trends and Drivers:

The Italy asset management market is dynamic, driven by a strong financial system and growing investor interest in diverse portfolios. The wealth management industry combines traditional banking and innovative investment options, serving both retail and institutional investors. A solid regulatory framework, with bodies like CONSOB, supports transparency and stability. Asset managers are focusing more on sustainable investments, reflecting global trends in ESG (Environmental, Social, Governance) criteria. Wealthy Italians and the rising middle class seek personalized financial products, increasing the demand for tailored solutions. Technological advances, including robo-advisors and digital platforms, are changing how firms connect with clients.

Italy’s asset management scene is competitive, with local and international players competing for market share. Major banks like UniCredit and Intesa Sanpaolo lead the market, but boutique firms and fintech startups are gaining ground by providing niche services. The market benefits from Italy’s strong economic ties within the European Union, aiding cross-border investments. Yet, challenges like economic uncertainty and changing market conditions require asset managers to remain flexible. Client preferences are shifting to alternative investments, such as real estate and private equity, diversifying traditional portfolios. The use of AI and data analytics is improving decision-making, allowing firms to provide more precise investment strategies. This evolving landscape positions Italy as a key player in European asset management.

Download a sample copy of the Report: https://www.imarcgroup.com/italy-asset-management-market/requestsample

Italy Asset Management Industry Segmentation:

The report has segmented the market into the following categories:

Asset Class Insights:

- Equality

- Fixed Income

- Alternative Investment

- Hybrid

- Cash Management

Source of Funds Insights:

- Pension Funds and Insurance Companies

- Individual Investors (Retail + High Net Worth Clients)

- Cooperate Investors

- Others

Asset Management Firms Insights:

- Large Financial Institutes/Bulge Brackets Banks

- Mutual Funds and ETFs

- Private Equality and Venture Capital

- Fixed Income Funds

- Hedge Funds

- Others

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145