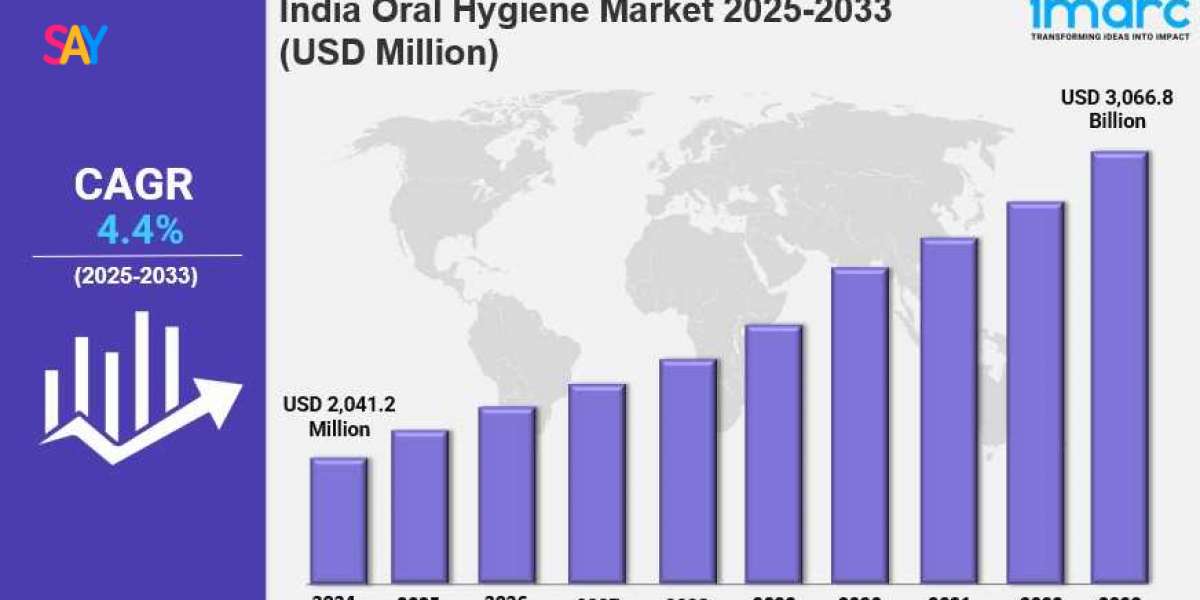

Market Overview 2025-2033

The India oral hygiene market size reached USD 2,041.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,066.8 Million by 2033, exhibiting a growth rate (CAGR) of 4.4% during 2025-2033. The market is experiencing steady growth, driven by rising health awareness, improved access to dental care, and increasing disposable incomes. Key trends include the demand for herbal and natural oral care products, with major players emphasizing innovation and eco-friendly packaging solutions.

Key Market Highlights:

✔️ Robust growth fueled by rising oral health awareness increasing disposable incomes

✔️ Growing demand for herbal, natural, and ayurvedic oral care products

✔️ Increasing adoption of sustainable packaging and eco-friendly product innovations

Request for a sample copy of the report: https://www.imarcgroup.com/india-oral-hygiene-market/requestsample

India Oral Hygiene Market Trends and Drivers:

In recent years, there has been a significant rise in awareness regarding oral health among Indian consumers, driving the growth of the India oral hygiene market. This shift is largely attributed to the increasing prevalence of dental issues such as cavities, gum disease, and bad breath, prompting individuals to prioritize their oral hygiene routines. Educational campaigns by governmental and non-governmental organizations have played a pivotal role in spreading awareness about the importance of maintaining proper oral hygiene. Consequently, products like toothpaste, mouthwash, and dental floss have experienced a surge in demand. The influence of social media and digital marketing has also contributed to this trend, with influencers and dental professionals promoting better oral care practices. Additionally, the growing middle-class population and rising disposable incomes have enabled consumers to invest in premium oral hygiene products, further propelling market growth. As awareness continues to expand, the demand for innovative and effective oral care solutions is expected to remain strong, shaping the future of the oral hygiene market in India.

Another notable trend in the India oral hygiene market is the increasing preference for natural and herbal products. With the rise of health-conscious consumers, many individuals are seeking alternatives to conventional oral care products that often contain synthetic ingredients and chemicals. Herbal toothpaste and mouthwashes, perceived as safer and more effective, are gaining popularity among consumers who favor products made from natural ingredients like neem, clove, and other traditional herbs. This shift is driven not only by health considerations but also by a growing interest in sustainable and eco-friendly products. Brands that emphasize the use of organic and natural components are gaining a competitive edge in the market. The demand for these products is expected to grow further as consumers become more educated about the benefits of using natural ingredients for oral care. By 2025, the market for herbal oral hygiene products is projected to expand significantly, reflecting broader trends in the wellness and natural products sectors.

The rise of e-commerce and digital platforms has transformed how consumers purchase India oral hygiene market. As online shopping becomes more popular, retailers are leveraging digital channels to reach a wider audience and enhance customer convenience. This trend has been accelerated by the COVID-19 pandemic, which prompted many consumers to shift towards online shopping for safety and ease. Major e-commerce platforms and brand-specific websites now offer a diverse range of oral hygiene products, often at competitive prices. Additionally, subscription services for regular deliveries of oral care products have gained traction, catering to busy consumers' needs. The digital landscape also allows for targeted marketing and personalized recommendations, leading to increased consumer engagement and loyalty. By 2025, the integration of advanced technologies like artificial intelligence and data analytics is expected to further enhance the online shopping experience, driving growth in the oral hygiene market as consumers become more accustomed to purchasing their dental care products online.

The India oral hygiene market is witnessing a transformative phase characterized by several key trends that reflect changing consumer preferences and behaviors. One significant trend is the increasing demand for premium and specialized oral care products. Consumers are becoming more discerning, seeking products that address specific needs such as sensitivity, whitening, and gum health. This trend is driven by a greater understanding of oral health issues and the desire for effective solutions. Additionally, innovative product formulations, such as charcoal-based toothpaste and probiotics for oral health, are capturing consumer interest. The growing popularity of subscription-based services allows consumers to receive their favorite oral care products regularly without hassle. Furthermore, the market is seeing a shift towards eco-friendly packaging and sustainable sourcing as consumers become more environmentally conscious. By 2025, these trends are expected to shape the competitive landscape of the oral hygiene market in India, driving brands to innovate and adapt to meet the evolving demands of health-conscious consumers.

India Oral Hygiene Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Product:

- Toothpaste

- Toothbrushes Accessories

- Mouthwash/Rinses

- Dental Accessories/Ancillaries

- Denture Products

- Dental Prosthesis Cleaning Solutions

- Others

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies

- Online Stores

- Others

Breakup by Application:

- Adults

- Kids

- Infants

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145