Loan management system streamlines MSME loan payments and collections

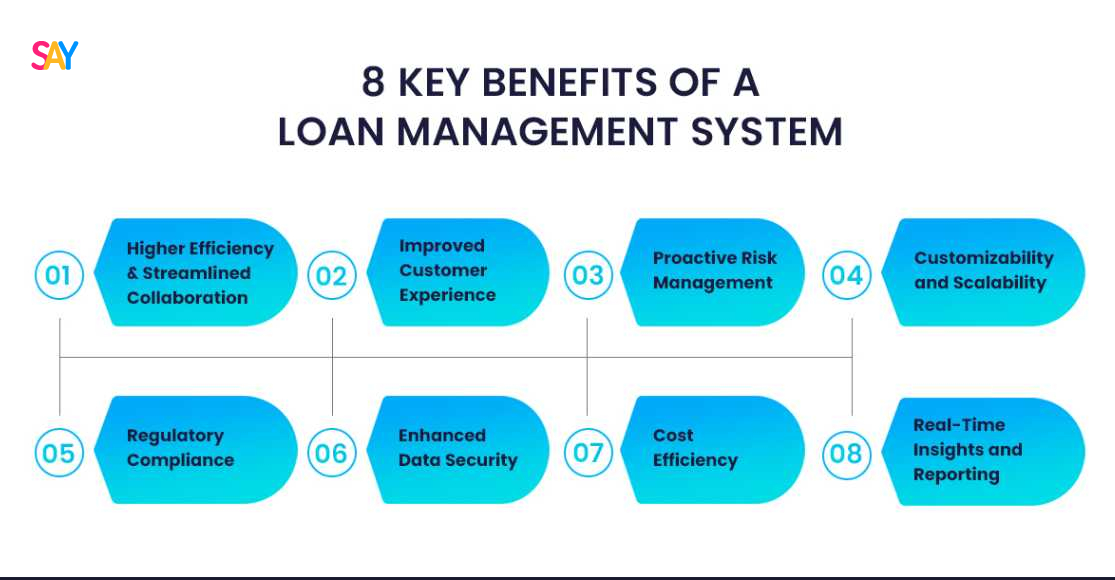

For Indian Banks and NBFCs focused on MSME lending, CredAcc’s API-first loan management system offers a comprehensive post-disbursal solution. It automates servicing, collections, and payment workflows, improving loan recovery and operational accuracy. The system’s API-first architecture enables seamless integration with other financial software, promoting flexibility and scalability.

Visit for more info :- https://www.credacc.com/loan-management-system

Mobile-First Lending Experience for Supply Chain Finance Operations

CredAcc’s no-code LOS and LMS platform helps Supply Chain Finance lenders digitize loan origination and servicing with minimal effort. The platform supports easy configuration of workflows for onboarding, credit checks, loan approval, disbursement, and repayment tracking. ERP integration ensures access to real-time financial data, improving credit decisions and portfolio management.

Visit for more info :- https://www.credacc.com/supply-chain-finance

Enable Faster Credit Flow in Supply Chain Finance Lending

CredAcc’s no-code Loan Origination and Loan Management solution is designed to help Supply Chain Finance lenders digitize and streamline their lending operations. The platform allows lenders to configure and automate credit workflows without coding, improving speed and accuracy. Integration with ERP systems provides real-time supply chain financial data for enhanced credit risk management and portfolio monitoring. Compliance tools ensure regulatory adherence

Visit for more info :- https://www.credacc.com/supply-chain-finance

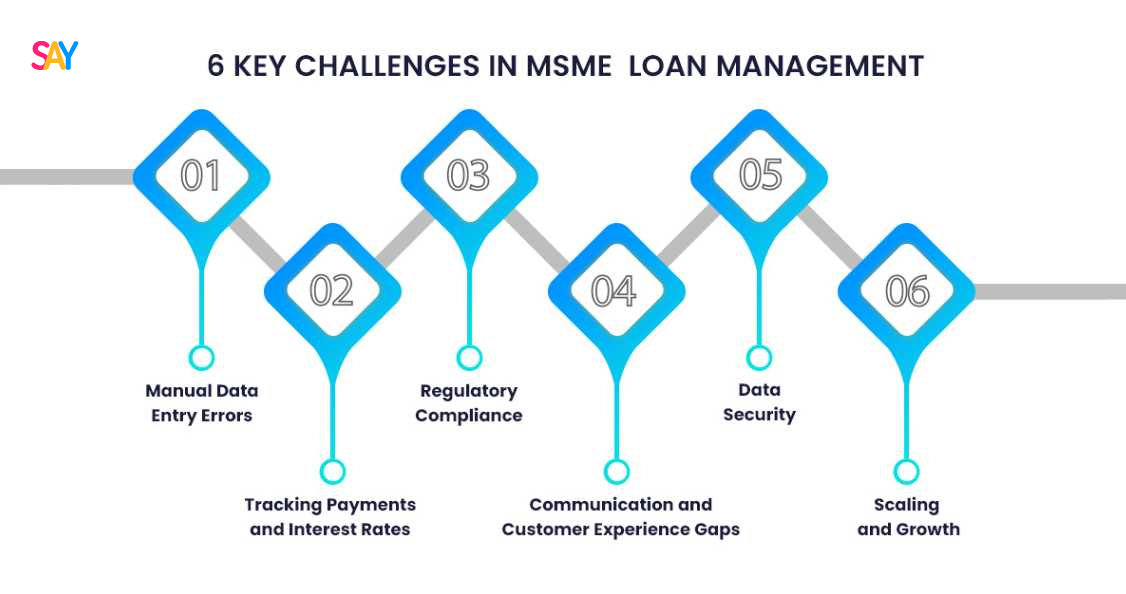

Streamline Your Loan Processing, Repayments, and Servicing with Our End-to-End Loan Management System.

Enhance your loan servicing capabilities with CredAcc’s Loan management system. This API-first platform automates key processes such as collections, payment tracking, and compliance reporting for MSME loans. Designed to integrate seamlessly with your bank’s systems, it allows for faster deployments and reduced manual interventions.

Visit for more info :- https://www.credacc.com/loan-management-system

Simplify Loan Origination and Servicing with Our Loan Management System—Powerful, Secure, and User-Friendly.

CredAcc’s Loan Management System is the digital backbone Indian banks and NBFCs need for MSME loan administration. The system automates post-disbursal processes such as servicing, collections, and payments, all within a flexible API-first framework. From integration to execution, CredAcc helps lenders manage loans efficiently, reduce defaults, and improve reporting accuracy.

Visit for more info :- https://www.credacc.com/loan-management-system