According to the latest report by IMARC Group, titled “Vietnam Steel Market Report by Type (Flat Steel, Long Steel), Product (Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids), Application (Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances), and Region 2025-2033”, offers a comprehensive analysis of the industry, which comprises insights on the Vietnam Steel Market. The report also includes competitor and regional analysis, and contemporary advancements in the global market.

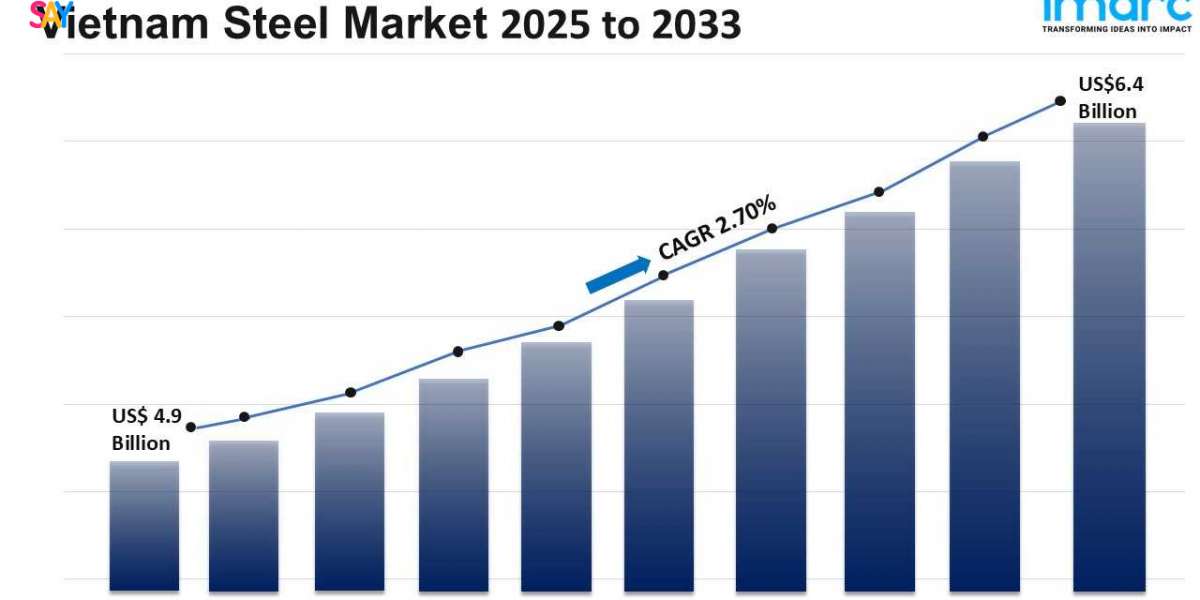

Vietnam steel market size reached USD 4.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.4 Billion by 2033, exhibiting a growth rate (CAGR) of 2.70% during 2025-2033. The rapid urbanization and industrialization in Vietnam, burgeoning automotive industry, introduction of various government initiatives and investments, flourishing shipbuilding in Vietnam, and rising foreign direct investments (FDIs) in the country represent some of the key factors driving the market.

Request Free Sample Report: https://www.imarcgroup.com/vietnam-steel-market/requestsample

Vietnam Steel Market Landscape

Surging Infrastructure Construction Investment Driving Robust Demand

Vietnam's steel market is experiencing a powerful demand surge, fundamentally underpinned by unprecedented levels of public and private infrastructure investment. The government's unwavering commitment to developing extensive transportation networks – including expressways, metro systems (notably in Hanoi and Ho Chi Minh City), airports, and deep-sea ports – consumes vast quantities of construction steel (rebar, wire rod, structural sections). Concurrently, a resilient real estate sector, encompassing large-scale residential projects, commercial hubs (offices, retail), and industrial parks catering to the expanding manufacturing base (especially electronics, textiles, and FDI-driven industries), fuels continuous demand for both long and flat steel products. Major public investment programs, consistently allocated significant portions of the national budget, act as primary catalysts. This robust domestic consumption, while periodically moderated by global economic headwinds impacting export-oriented manufacturing, remains the dominant growth engine for the foreseeable future, requiring consistent raw material imports and driving capacity utilization among integrated mills and rerollers alike. The strategic focus on upgrading national infrastructure and urban development creates a sustained, multi-year demand cycle central to the market's vitality.

Intensifying Competition Market Consolidation Reshaping the Landscape

The Vietnamese steel industry is undergoing a significant structural shift characterized by heightened competition and accelerating consolidation, moving beyond the era of numerous fragmented small players. Leading integrated producers like Hoa Phat Group and Formosa Ha Tinh Steel are aggressively expanding capacities and diversifying high-value product portfolios (automotive-grade, coated coils, specialty pipes), leveraging economies of scale and vertical integration advantages to solidify dominance. This expansion intensifies pressure on smaller electric arc furnace (EAF) producers and rerollers, who face critical challenges including volatile scrap prices, tighter environmental regulations, and shrinking margins. Market consolidation is becoming inevitable, driven by the need for operational efficiency, investment capability in cleaner technologies, and competitive pricing power. Simultaneously, competition from imports, particularly from strategic partners within ASEAN benefiting from trade agreements and occasionally from China during periods of domestic oversupply, adds another layer of complexity. This dynamic compels all players to enhance operational excellence, optimize costs, innovate in product offerings, and strengthen distribution networks to maintain or gain market share in an increasingly competitive and concentrated environment.

Sustainability Imperative Technological Transformation Gaining Momentum

Environmental, Social, and Governance (ESG) considerations are rapidly transitioning from peripheral concerns to core strategic imperatives for Vietnam's steel sector. Mounting pressure from both domestic regulators enforcing stricter emission standards (e.g., Decree 08/2022/ND-CP) and international buyers demanding greener supply chains is compelling significant investment in sustainable production technologies. Leading mills are actively exploring and deploying solutions such as Electric Arc Furnaces (EAFs) utilizing scrap metal, investing in advanced emission control systems (de-dusting, de-SOx, de-NOx), implementing comprehensive energy recovery programs, and gradually investigating pathways for carbon capture utilization and storage (CCUS) and hydrogen-based reduction. Beyond environmental compliance, this shift is driven by long-term cost efficiency (energy savings), access to premium international markets with carbon border mechanisms (like CBAM), and enhanced corporate reputation. Concurrently, digital transformation – encompassing Industry 4.0 applications like AI-driven predictive maintenance, process optimization, smart logistics, and blockchain for supply chain transparency – is being adopted to boost productivity, quality control, and resource efficiency, making sustainability and technological innovation inseparable drivers for future competitiveness and resilience.

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Vietnam Steel Market Trends

The Vietnamese steel industry is navigating a complex landscape defined by several interconnected trends shaping its near-term evolution. Domestic demand resilience remains a cornerstone, heavily anchored in the government's sustained infrastructure push, particularly in transportation and energy, alongside ongoing activity in residential and industrial construction, although subject to careful monitoring of real estate sector adjustments. This demand stability, however, coexists with the persistent challenge of raw material import dependency for key inputs like iron ore, coking coal, and ferrous scrap, making the sector inherently vulnerable to global price volatility and supply chain disruptions, necessitating sophisticated procurement strategies and inventory management. In response to competitive pressures and evolving customer needs, product diversification and value chain enhancement are accelerating, with major players actively expanding into higher-margin segments such as cold-rolled coil (CRC), galvanized steel (GI/GL), color-coated steel (PPGI), and specialized sections for automotive and appliance manufacturing, moving beyond basic construction steel commoditization. The sustainability transition is no longer optional; investments in energy efficiency, emission reduction technologies (especially for integrated BF-BOF routes), and increased scrap utilization via EAFs are critical for regulatory compliance, cost management, and maintaining export market access amid rising global green steel requirements. Finally, operational efficiency through digitalization is becoming a key differentiator, with forward-looking companies implementing advanced data analytics, automation, and IoT solutions to optimize production processes, enhance quality control, reduce waste, and streamline logistics, directly impacting bottom-line performance in a competitive market. Navigating these trends effectively requires strategic agility and continuous investment from market participants.

Ask Our Expert Browse Full Report with TOC List of Figure: https://www.imarcgroup.com/request?type=reportid=19491flag=C

Vietnam Steel Market Industry Segmentation:

Type Insights:

- Flat Steel

- Long Steel

Product Insights:

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

Application Insights:

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Key highlights of the Report:

- Market Performance

- Market Outlook

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145