According to the latest report by IMARC Group, titled “Vietnam Cryptocurrency Market Report by Type (Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, and Others), Component (Hardware, Software), Process (Mining, Transaction), Application (Trading, Remittance, Payment, and Others), and Region 2025-2033”, offers a comprehensive analysis of the industry, which comprises insights on the Vietnam cryptocurrency market. The report also includes competitor and regional analysis, and contemporary advancements in the global market.

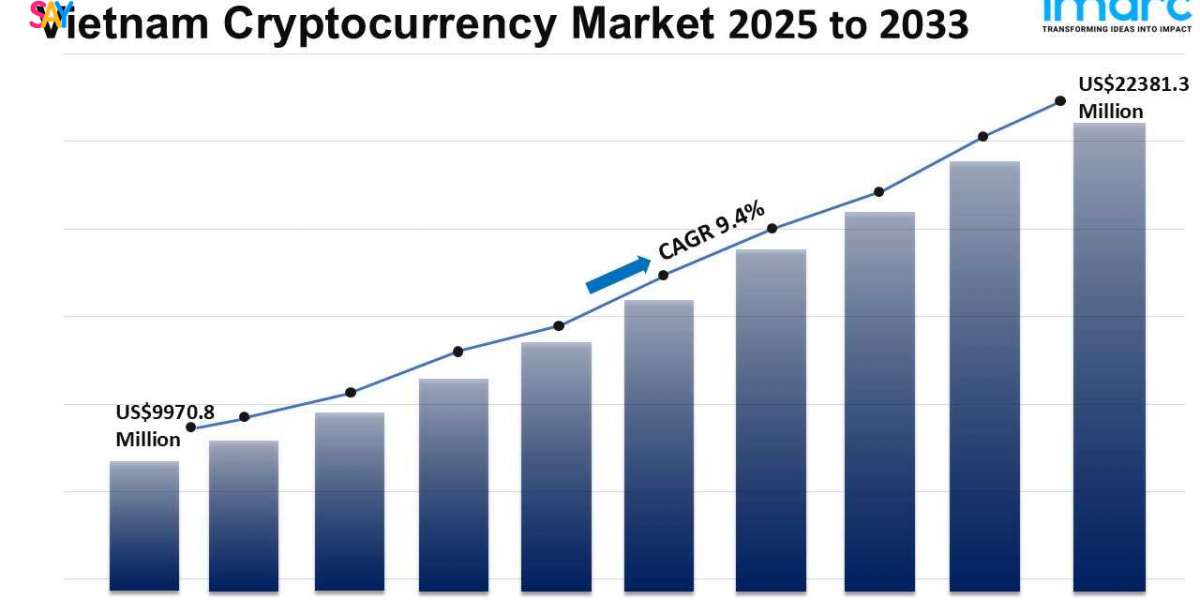

Vietnam cryptocurrency market size reached USD 9,970.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 22,381.3 Million by 2033, exhibiting a growth rate (CAGR) of 9.4% during 2025-2033.

Request Free Sample Report: https://www.imarcgroup.com/vietnam-cryptocurrency-market/requestsample

Vietnam Cryptocurrency Market Dynamics:

Regulatory Evolution and Government Support

Vietnam's cryptocurrency market is undergoing a transformative phase, driven by proactive government initiatives and the recent passage of the Law on Digital Technology Industry. This landmark legislation, effective from January 2026, introduces Vietnam’s first comprehensive legal framework for digital assets, encompassing both crypto and virtual assets 1. The law aims to balance innovation with risk control, offering regulatory clarity that is expected to attract institutional investors and foster a safer trading environment. Complementing this, the Ministry of Finance has proposed a pilot crypto-asset market, setting stringent criteria for exchange operators, including a minimum charter capital of VND 10 trillion 2. These developments signal Vietnam’s commitment to becoming a regional blockchain hub, aligning with global standards while tailoring policies to local economic realities. The regulatory momentum is not only curbing fraud and enhancing investor protection but also unlocking new investment channels and enabling capital mobilization for enterprises. As Vietnam transitions from a loosely regulated space to a structured digital asset economy, the market is poised for sustainable growth and increased institutional participation.

Investor Behavior and Market Sentiment

Vietnamese crypto investors exhibit a unique blend of optimism and agility, shaping the market’s dynamic nature. Over 50% of investors reported profits in the past year, with 93.5% expressing confidence in an upcoming altcoin season 3. The market is predominantly driven by young investors under 35, who account for 75% of participants, and rely heavily on peer recommendations and social media for investment decisions. Centralized exchanges (CEXs) remain the preferred trading platforms, with 74.4% usage, while decentralized exchanges (DEXs) lag behind3. Solana has overtaken Ethereum as the leading ecosystem, fueled by the memecoin trend and the integration of emerging technologies like AI and SocialFi. However, the market faces challenges such as declining patience levels and a preference for short-term gains, which could hinder long-term stability. Addressing these behavioral biases through education and strategic policy interventions will be critical to fostering a mature investment culture. The prevailing sentiment reflects a bullish outlook, with many predicting Bitcoin to surpass $120,000, underscoring strong belief in a sustained bull cycle.

Technological Adoption and Ecosystem Expansion

Vietnam’s cryptocurrency ecosystem is expanding rapidly, supported by robust digital infrastructure and a thriving tech startup culture. Cities like Ho Chi Minh City and Hanoi serve as innovation hubs, hosting the majority of exchanges, fintech startups, and blockchain companies 4. The Vietnam Blockchain Union, established in 2022, continues to promote research and collaboration across academia and industry. The market is segmented across diverse applications including remittances, e-commerce, DeFi, and trading, with remittances leading due to low transaction costs and fast cross-border transfers 4. The integration of blockchain into public services and financial systems is gaining traction, with universities and tech institutes actively contributing to education and talent development. The rise of AI-powered trading tools and SocialFi platforms is reshaping user engagement and investment strategies. As Vietnam embraces digital transformation, the synergy between blockchain, fintech, and AI is expected to drive innovation, enhance user experience, and create scalable solutions for both retail and institutional investors.

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Vietnam Cryptocurrency Market Trends

Vietnam’s cryptocurrency market is evolving into a vibrant and competitive landscape, marked by strong investor enthusiasm, regulatory advancements, and technological innovation. The recent legal recognition of digital assets has catalyzed institutional interest, while the pilot crypto-asset exchange framework is laying the groundwork for a regulated trading environment. Young investors dominate the market, favoring ecosystems like Solana and engaging heavily in memecoin trends. Centralized exchanges continue to lead, but decentralized platforms are gaining traction as users seek greater autonomy. The integration of artificial intelligence and SocialFi is redefining investment tools, enabling smarter decision-making and personalized trading experiences. Despite the bullish sentiment, challenges such as overreliance on social influence and short-term investment behavior persist. Addressing these through financial literacy and strategic regulation will be key to long-term sustainability. Vietnam’s commitment to digital innovation, coupled with its growing blockchain infrastructure, positions it as a rising leader in the global crypto economy.

Explore the Full Report with Charts, Table of Contents, and List of Figures: https://www.imarcgroup.com/request?type=reportid=19745flag=C

Vietnam Cryptocurrency Market Industry Segmentation:

Type Insights:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

Component Insights:

- Hardware

- Software

Process Insights:

- Mining

- Transaction

Application Insights:

- Trading

- Remittance

- Payment

- Others

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, Australia, Indonesia, Korea, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa (United Arab Emirates, Saudi Arabia, Qatar, Iraq, Other)

Key highlights of the Report:

- Market Performance

- Market Outlook

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145