Saudi Arabia Telecom Market Overview

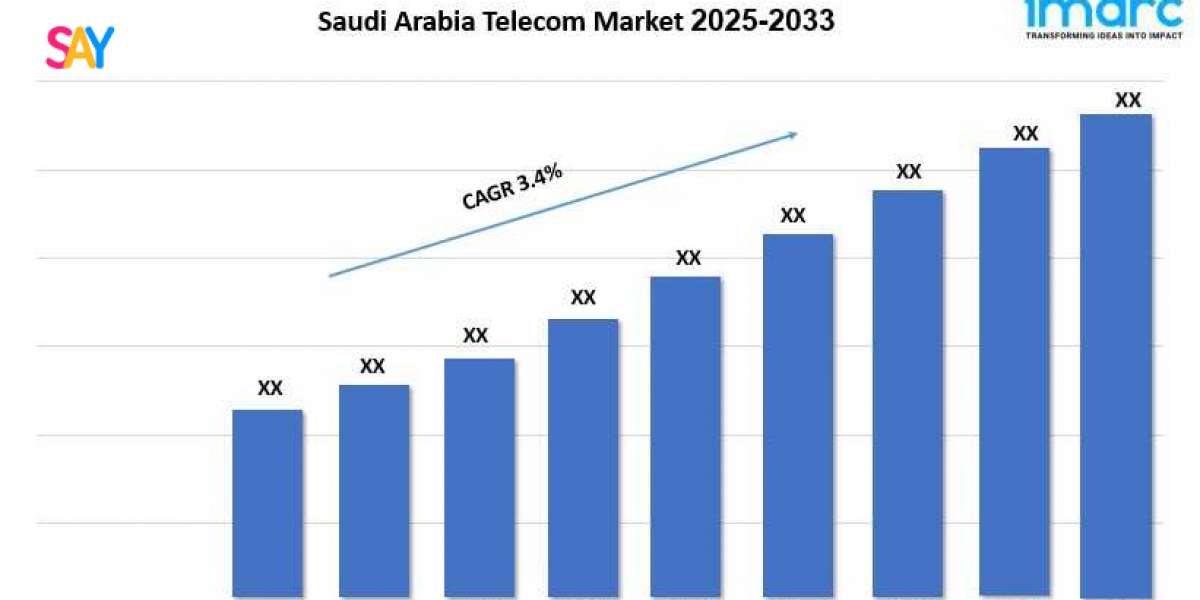

Market Size in 2024 : USD 16.8 Billion

Market Size in 2033: USD 22.7 Billion

Market Growth Rate 2025-2033: 3.4%

According to IMARC Group's latest research publication,"Saudi Arabia Telecom Market Report by Type (Mobile, Fixed-Line, Broadband), and Region 2025-2033", Saudi Arabia telecom market size reached USD 16.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 22.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.4% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-telecom-market/requestsample

Growth Factors in the Saudi Arabia Telecom Market

- Vision 2030 and Digital Transformation Initiatives

Saudi Arabia’s Vision 2030 is a pivotal force driving the telecom market, emphasizing digital transformation to diversify the economy. This initiative fuels demand for advanced telecom services to support smart cities, e-commerce, and digital governance. For example, the NEOM project relies on robust telecom infrastructure to enable IoT and smart urban solutions, boosting the Saudi Arabia telecom market revenue 2023. Government-backed programs encourage partnerships, such as stc Group’s collaboration with GO Telecom to enhance IoT services, strengthening connectivity for businesses and consumers. This focus on digitalization creates a fertile ground for telecom operators to innovate and expand, meeting the needs of a tech-driven economy.

- Rapid Urbanization and Smartphone Penetration

The rapid urbanization in Saudi Arabia, coupled with widespread smartphone adoption, significantly propels the telecom market. With a growing urban population and a tech-savvy youth demographic, demand for high-speed mobile data and innovative services is surging. For instance, major cities like Riyadh and Jeddah see heavy reliance on 4G and 5G networks for streaming and e-commerce. This trend drives telecom operators like Zain KSA to invest in network upgrades, contributing to the Saudi Arabia telecom market revenue 2023. The proliferation of smartphones fuels demand for data-heavy applications, encouraging providers to enhance network capacity and offer tailored digital solutions.

- Expansion of Fiber-Optic Infrastructure

Investment in fiber-optic infrastructure is a key growth factor, enhancing broadband connectivity across Saudi Arabia. Projects like Dawiyat Integrated’s initiative to deploy high-speed broadband to remote areas exemplify this trend, improving access and reliability. These developments support the Saudi Arabia telecom market revenue 2023 by enabling faster internet speeds for businesses and households. Fiber-optic networks are crucial for smart city projects and industries like healthcare and education, which rely on seamless connectivity. By prioritizing fixed-line infrastructure, telecom operators like STC ensure robust data services, catering to the rising demand for high-bandwidth applications and fostering market growth.

Key Trends in the Saudi Arabia Telecom Market

- Accelerated 5G Network Deployment

The rapid rollout of 5G networks is transforming the Saudi Arabia telecom market, enabling faster speeds and lower latency. Operators like Zain KSA and Nokia are collaborating to expand 5G coverage, particularly in major cities, supporting applications like autonomous vehicles and smart grids. This trend significantly boosted the Saudi Arabia telecom market revenue 2023, as consumers and businesses adopted 5G-enabled services. For example, STC’s 5G initiatives enhance connectivity during high-traffic events like Hajj, improving user experiences. The focus on 5G reflects Saudi Arabia’s ambition to lead in global telecom innovation, driving demand for advanced digital solutions.

- Integration of IoT and Smart Solutions

The growing adoption of IoT and smart solutions is a defining trend, driven by the need for connected devices in sectors like transportation and healthcare. Telecom operators are leveraging IoT to offer innovative services, such as stc B2B’s fleet management solutions for real-time vehicle tracking. This trend contributed to the Saudi Arabia telecom market revenue 2023 by addressing industry-specific needs. Smart city initiatives, like those in Riyadh, rely on IoT for efficient urban management, supported by robust telecom networks. This integration fosters a digital ecosystem, encouraging telecom providers to develop tailored solutions for diverse applications.

- Emphasis on Cybersecurity and Data Privacy

Increasing consumer demand for data protection is shaping the telecom market, with operators prioritizing cybersecurity. Regulatory frameworks are evolving to ensure secure digital ecosystems, as seen in partnerships like Exotel’s AI-driven cloud platform for enhanced customer experiences. This focus on security bolstered the Saudi Arabia telecom market revenue 2023 by building consumer trust. For instance, telecom providers implement advanced encryption to safeguard user data, critical for e-commerce and digital banking. As data breaches pose risks, operators are investing in transparent privacy policies, aligning with Vision 2030’s goal of a secure, digitally inclusive economy.

Saudi Arabia Telecom Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Type:

- Mobile

- Fixed-Line

- Broadband

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Future Outlook

The Saudi Arabia telecom market is set for dynamic growth, driven by ongoing digital transformation and infrastructure investments aligned with Vision 2030. The continued expansion of 5G and fiber-optic networks will enhance connectivity, supporting smart cities and digital services across industries. Partnerships, such as STC’s collaboration with global tech firms, will drive innovation in IoT and AI-driven solutions, further boosting the Saudi Arabia telecom market revenue 2023 and beyond. However, challenges like regulatory complexities and economic volatility may require operators to adopt cost-efficient technologies. With a focus on cybersecurity and sustainable solutions, the market is poised to become a global leader in telecom innovation.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145